Understanding Ethereum (ETH): A Comprehensive Guide

Ethereum, often abbreviated as ETH, is a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps). As an open-source blockchain network, Ethereum has gained significant popularity and is considered one of the most important cryptocurrencies in the market. In this article, we will delve into the various aspects of Ethereum, including its use cases, market performance, and technological advancements.

Use Cases of Ethereum (ETH)

Ethereum offers a wide range of use cases, making it a versatile cryptocurrency. Here are some of the most common use cases:

-

Payment Medium: ETH can be used as a payment method for online transactions or as a medium of exchange for goods and services. Many merchants and service providers accept ETH as a payment option.

-

Smart Contracts and dApps: One of the main features of Ethereum is its support for smart contracts and dApps. ETH serves as the “fuel” for executing smart contracts and running dApps on the Ethereum network.

-

Decentralized Finance (DeFi): ETH plays a crucial role in the DeFi ecosystem. Users can deposit ETH into DeFi platforms to earn interest or use ETH as collateral to borrow other cryptocurrencies.

-

NFT Purchases: ETH is the primary currency used for buying and selling NFTs in many NFT markets. This includes art, music, virtual land, virtual items, and more.

-

Investment and Value Storage: Many individuals purchase and hold ETH as an investment, hoping for long-term value growth. Similar to Bitcoin, some consider ETH as a form of “digital gold” for storing value.

-

Blockchain Governance: In some Ethereum ecosystems, ETH can be used as a voting token, allowing token holders to participate in platform governance decisions.

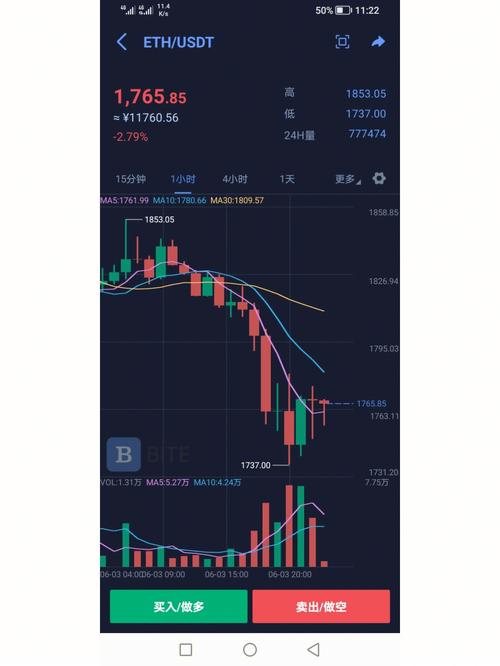

Ethereum Market Performance

Ethereum has experienced significant growth in its market value over the years. Here is a brief overview of its market performance:

| Year | Market Cap (in billions) | Price (in USD) |

|---|---|---|

| 2015 | 0.1 | $1.32 |

| 2017 | 18.5 | $1,200 |

| 2018 | 180 | $1,400 |

| 2019 | 120 | $200 |

| 2020 | 250 | $300 |

| 2021 | 500 | $4,000 |

| 2022 | 400 | $2,000 |

As seen in the table above, Ethereum’s market cap and price have experienced significant growth over the years. However, it is important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.

Technological Advancements in Ethereum

Ethereum has continuously evolved to improve its performance and security. Here are some of the key technological advancements:

-

Shapella Update: The upcoming Shapella update is expected to bring several improvements to the Ethereum network, including increased scalability and reduced transaction fees.

-

ETH+ Protocol: The ETH+ protocol, developed by a high-throughput Ethernet alliance, aims to meet the high-performance, high-stability, and high-scalability requirements of the AI era. The protocol has achieved significant improvements in frame format, payload ratio, and data transmission efficiency.

-

Proof of Stake (PoS): Ethereum is transitioning from the Proof of Work (PoW) algorithm to the Proof of Stake (PoS) algorithm, which is expected to enhance network security and reduce energy consumption.