Understanding Binance ETH Trading Fees: A Comprehensive Guide

When it comes to trading Ethereum (ETH) on Binance, one of the most crucial aspects to consider is the trading fee structure. As a trader, understanding how fees are calculated and how they can impact your profits is essential. In this detailed guide, we will delve into the various dimensions of Binance ETH trading fees, ensuring you have a comprehensive understanding of the process.

How are Binance ETH Trading Fees Calculated?

Binance employs a tiered fee structure for ETH trading, which is based on the trading volume you generate over a 30-day period. The more you trade, the lower your fees become. Here’s a breakdown of how the fees are calculated:

| Trading Volume (30-Day) | Maker Fee | Taker Fee |

|---|---|---|

| < 50 BNB | 0.10% | 0.10% |

| 50 – 100 BNB | 0.09% | 0.10% |

| 100 – 500 BNB | 0.08% | 0.10% |

| 500 – 1,000 BNB | 0.07% | 0.10% |

| 1,000 – 10,000 BNB | 0.06% | 0.10% |

| > 10,000 BNB | 0.05% | 0.10% |

It’s important to note that the fees for trading other cryptocurrencies on Binance are similar to those for ETH, with slight variations in the tiered structure.

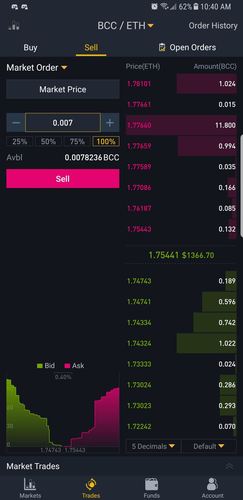

Understanding the Difference Between Maker and Taker Fees

In the Binance trading fee structure, there are two types of fees: maker and taker fees. Here’s what you need to know about each:

Maker Fees: These fees are charged to users who place limit orders that are not immediately filled. In other words, if you submit a limit order and it remains unfilled, you will be charged a maker fee. The purpose of this fee is to incentivize users to provide liquidity to the market.

Taker Fees: These fees are charged to users who fill orders placed by others. If you submit a market order or a limit order that gets immediately filled, you will be charged a taker fee. This fee is designed to discourage excessive order placement and to ensure that the market remains efficient.

How to Reduce Your Binance ETH Trading Fees

Now that you understand how Binance ETH trading fees are calculated, let’s explore some strategies to help you reduce your fees:

- Trade More: As mentioned earlier, the more you trade, the lower your fees will be. Aim to reach higher trading volume tiers to benefit from reduced fees.

- Use Limit Orders: By using limit orders instead of market orders, you can avoid paying taker fees and potentially lower your overall trading costs.

- Join the Binance Referral Program: By referring friends to Binance, you can earn a portion of their trading fees, which can help offset your own costs.

- Participate in Binance’s Fee Discount Programs: Binance occasionally offers fee discounts for certain trading pairs or during specific promotions. Keep an eye out for these opportunities to save on your fees.

Conclusion

Understanding Binance ETH trading fees is crucial for any Ethereum trader looking to maximize their profits. By familiarizing yourself with the tiered fee structure, the difference between maker and taker fees, and strategies to reduce your fees, you can make more informed trading decisions. Remember to stay up-to-date with any changes to the fee structure and take advantage of any opportunities to save on your trading costs.