Ark, Ethereum, and ETF: A Comprehensive Guide

Investing in the cryptocurrency market can be both exciting and challenging. With the rise of digital currencies, many investors are looking for ways to diversify their portfolios. Two of the most popular cryptocurrencies are Ark and Ethereum, and one of the most sought-after investment vehicles is the Ethereum ETF. In this article, we will delve into the details of these three entities, providing you with a comprehensive guide to help you make informed decisions.

Understanding Ark

Ark is a cryptocurrency that aims to provide a decentralized platform for the development of decentralized applications (DApps). It is built on the Ethereum blockchain and utilizes the Proof of Stake (PoS) consensus mechanism. Ark’s unique feature is its governance model, which allows token holders to vote on various aspects of the network, including the addition of new features and the selection of delegates who validate transactions.

Ark’s native token, ARK, is used for governance, transaction fees, and as a medium of exchange within the Ark ecosystem. The ARK token has seen significant growth since its inception, and it is now listed on several major cryptocurrency exchanges.

Ethereum: The King of Smart Contracts

Ethereum is one of the most popular cryptocurrencies in the market, known for its innovative smart contract functionality. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. This allows for the creation of decentralized applications that can automate various processes, from simple transactions to complex agreements.

Ethereum’s native token, ETH, is used to pay for transaction fees and to participate in the network’s governance. The Ethereum network has seen rapid growth, with a growing number of DApps and decentralized finance (DeFi) projects being built on top of it. Ethereum is also planning to transition to a more energy-efficient PoS consensus mechanism, known as Ethereum 2.0, which is expected to further enhance its scalability and sustainability.

Ethereum ETF: A New Investment Vehicle

An Ethereum ETF is an exchange-traded fund that tracks the price of ETH. This investment vehicle allows investors to gain exposure to Ethereum without having to directly purchase and store the cryptocurrency. The first Ethereum ETF, the ProShares Ethereum Strategy ETF (CBOE: ETHO), was launched in late 2020, and it has since seen significant interest from investors.

ETFs offer several advantages over direct cryptocurrency investments. For one, they provide liquidity, as they can be bought and sold on major stock exchanges. Additionally, they offer regulatory oversight, as they are subject to the same rules and regulations as traditional stock exchanges. This can provide investors with a sense of security and confidence in their investments.

Ark vs. Ethereum: A Comparison

When comparing Ark and Ethereum, it’s important to consider their unique features and goals. Ark is focused on providing a decentralized platform for DApps, while Ethereum is known for its smart contract capabilities and its role as the leading platform for DApps and DeFi projects.

Ark’s governance model is one of its standout features, as it allows token holders to have a say in the network’s future. Ethereum, on the other hand, has a more centralized governance model, with decisions being made by a small group of core developers.

In terms of market capitalization, Ethereum is significantly larger than Ark. As of the time of writing, Ethereum has a market capitalization of over $200 billion, while Ark’s market capitalization is around $1.5 billion. This difference in market capitalization reflects the varying levels of interest and investment in each cryptocurrency.

Investing in Ark, Ethereum, and ETFs

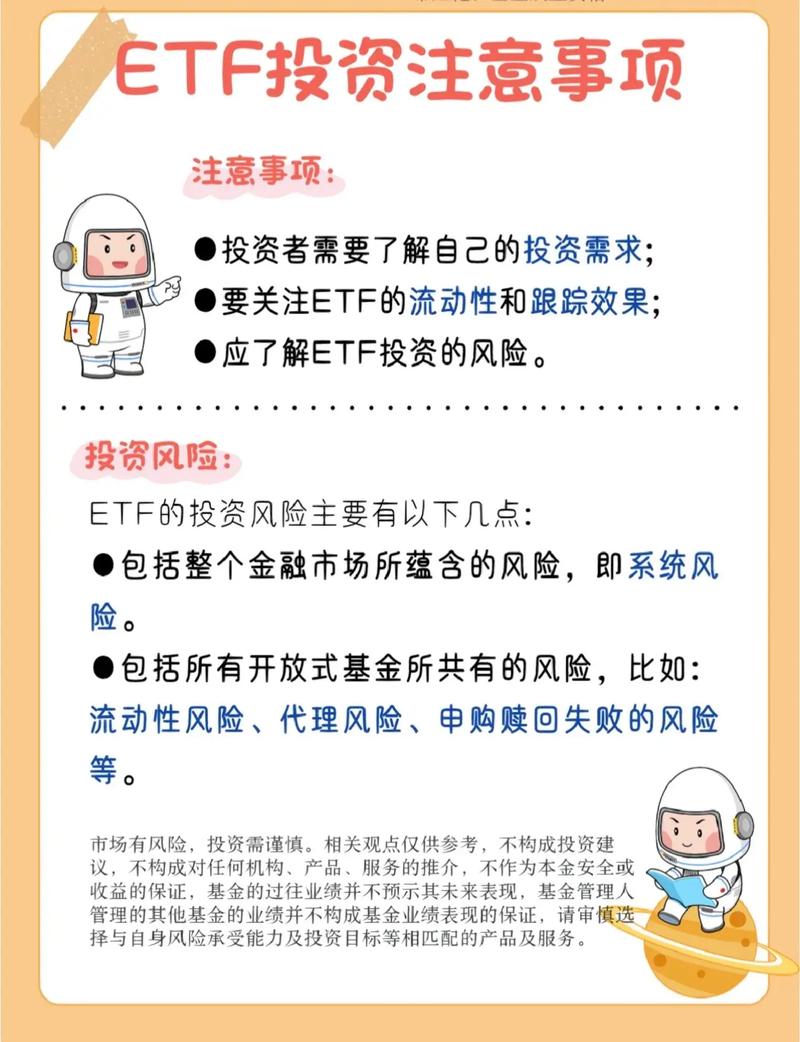

When considering an investment in Ark, Ethereum, or an Ethereum ETF, it’s important to do thorough research and understand the risks involved. Cryptocurrencies are highly volatile, and their prices can fluctuate significantly in a short period of time.

Before investing, you should assess your risk tolerance and investment goals. If you are looking for a long-term investment with the potential for significant growth, Ark or Ethereum may be suitable options. However, if you prefer a more conservative approach and are looking for exposure to the cryptocurrency market without the need to directly purchase and store the cryptocurrency, an Ethereum ETF may be a better choice.

It’s also important to consider the regulatory environment surrounding cryptocurrencies and ETFs. As the market continues to evolve, regulations may change, which could impact the value of your investments.

In conclusion, Ark, Ethereum, and Ethereum ETFs offer unique opportunities for investors looking to diversify their portfolios. By understanding the features and risks associated with each of these entities, you can make informed decisions that align with your investment goals and risk tolerance.