Are ETH ETFs Approved?

Understanding the regulatory landscape surrounding Ethereum (ETH) exchange-traded funds (ETFs) is crucial for investors looking to diversify their portfolios with this popular cryptocurrency. In this detailed exploration, we delve into the current status of ETH ETF approvals, their implications, and what it means for the market.

What is an ETH ETF?

An Ethereum ETF is a financial product that tracks the price of Ethereum and allows investors to gain exposure to the cryptocurrency without owning the actual ETH. These funds are typically structured as exchange-traded funds, which means they trade on a stock exchange like a stock.

Regulatory Status: A Global Perspective

The approval of ETH ETFs varies significantly across different countries due to varying regulatory frameworks. Here’s a breakdown of the current status in some key markets:

| Country | Status | Key Regulator |

|---|---|---|

| United States | Partial Approval | SEC |

| Canada | Full Approval | CSA |

| Europe | Partial Approval | ESMA |

| Asia | Not Yet Approved | Varies by Country |

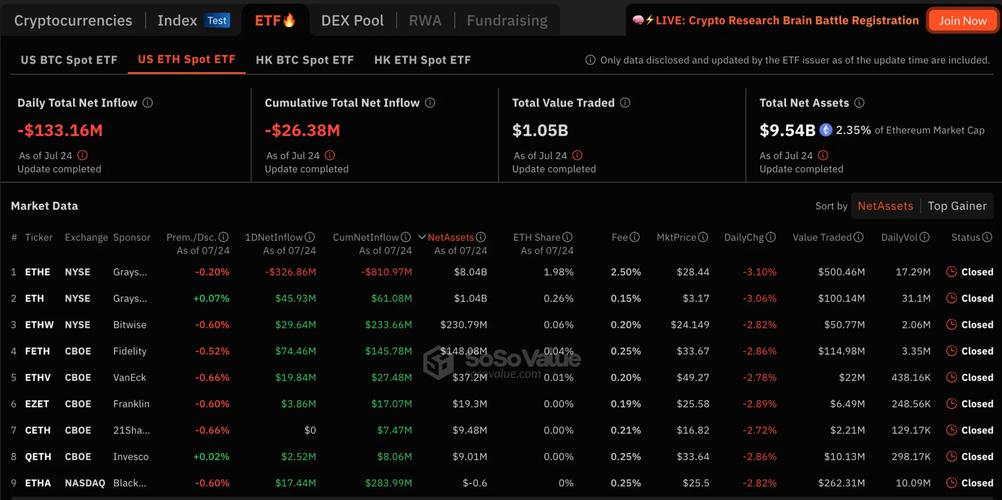

In the United States, the Securities and Exchange Commission (SEC) has approved a few ETH ETFs, but many applications are still pending. Canada, on the other hand, has fully approved several ETH ETFs, making it a favorable market for investors. Europe and Asia are still in the process of evaluating and approving ETH ETFs.

Implications of ETH ETF Approvals

The approval of ETH ETFs has several implications for the market:

-

Increased Accessibility: ETH ETFs make it easier for retail investors to gain exposure to Ethereum without the complexities of buying and storing the cryptocurrency.

-

Market Liquidity: The introduction of ETH ETFs can increase the liquidity of Ethereum, as more investors will be able to trade the cryptocurrency through these funds.

-

Regulatory Compliance: ETH ETFs are subject to strict regulatory oversight, which can enhance the overall trust and credibility of the cryptocurrency market.

Investor Considerations

Before investing in an ETH ETF, consider the following factors:

-

Management Fees: Compare the management fees of different ETH ETFs to ensure you’re getting the best value for your investment.

-

Tracking Error: Evaluate the tracking error of the ETF to ensure it closely mirrors the performance of Ethereum.

-

Market Risk: Understand the risks associated with investing in a cryptocurrency, as prices can be highly volatile.

Conclusion

The approval of ETH ETFs is a significant development in the cryptocurrency market, offering investors new ways to gain exposure to Ethereum. While the regulatory landscape varies across different countries, the overall trend is towards increased approval and acceptance. As an investor, stay informed about the latest developments and consider the factors mentioned above before making your investment decisions.