Determining Trade Value Against BTC, ETH, and LTV: A Comprehensive Guide

When it comes to cryptocurrency trading, determining the trade value against Bitcoin (BTC), Ethereum (ETH), and the Liquidity Transfer Value (LTV) is crucial for making informed decisions. In this detailed guide, we will explore various aspects to help you understand how to evaluate trade values effectively.

Understanding Bitcoin (BTC)

Bitcoin, often referred to as the “gold of cryptocurrencies,” is the first and most prominent digital currency. Its value has been a benchmark for other cryptocurrencies. Here are some key factors to consider when determining trade value against BTC:

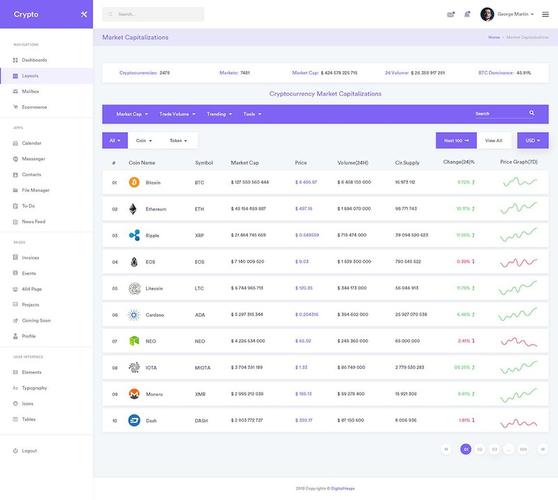

- Market Capitalization: BTC’s market capitalization is a significant indicator of its value. It represents the total value of all BTC in circulation.

- Supply and Demand: The supply of BTC is capped at 21 million, making it a scarce asset. The demand for BTC can influence its value.

- Market Sentiment: The sentiment of the market towards BTC can impact its value. Factors like regulatory news, technological advancements, and macroeconomic conditions can influence sentiment.

Understanding Ethereum (ETH)

Ethereum is the second-largest cryptocurrency by market capitalization and is known for its smart contract capabilities. Here are some factors to consider when evaluating trade value against ETH:

- Market Capitalization: ETH’s market capitalization is a crucial indicator of its value, similar to BTC.

- Supply and Demand: The supply of ETH is not capped, but its inflation rate is predetermined. The demand for ETH can influence its value.

- Network Activity: The level of activity on the Ethereum network, such as the number of transactions and smart contracts deployed, can impact ETH’s value.

Understanding Liquidity Transfer Value (LTV)

Liquidity Transfer Value (LTV) is a metric that measures the value of a cryptocurrency relative to its market capitalization. It is calculated by dividing the market capitalization by the total supply of the cryptocurrency. Here’s how to determine trade value against LTV:

- Market Capitalization: LTV is based on the market capitalization of a cryptocurrency.

- Total Supply: The total supply of the cryptocurrency is used to calculate LTV.

- Relative Value: LTV provides a relative value of a cryptocurrency compared to its market capitalization and total supply.

Comparing BTC, ETH, and LTV

Now that we have a basic understanding of BTC, ETH, and LTV, let’s compare them to determine trade value:

| Cryptocurrency | Market Capitalization | Supply and Demand | Network Activity | Liquidity Transfer Value (LTV) |

|---|---|---|---|---|

| Bitcoin (BTC) | High | Scarce | Low | High |

| Ethereum (ETH) | High | Not Capped | High | Medium |

| Liquidity Transfer Value (LTV) | Varies | Varies | Varies | Varies |

As you can see, BTC has a high market capitalization, scarcity, and LTV, making it a valuable asset. ETH has a high market capitalization, not capped supply, high network activity, and a medium LTV. LTV varies depending on the cryptocurrency and its market conditions.

Factors to Consider When Determining Trade Value

When determining trade value against BTC, ETH, and LTV, consider the following factors:

- Market Trends: Analyze the market trends and patterns to identify potential opportunities.

- News and Events: Stay updated with