Understanding the Basics of BTC and ETH

Before diving into the correlation between Bitcoin (BTC) and Ethereum (ETH), it’s essential to have a basic understanding of both cryptocurrencies. BTC, launched in 2009, is the first decentralized digital currency, often referred to as “digital gold.” ETH, launched in 2015, is a blockchain platform that enables the creation of decentralized applications (DApps) and smart contracts.

Market Dynamics and Correlation

The correlation between BTC and ETH can be observed through various dimensions. One of the most significant aspects is their market dynamics. Both cryptocurrencies have shown a strong positive correlation over the years, meaning that when one rises, the other tends to follow suit. This correlation can be attributed to several factors:

| Factor | Description |

|---|---|

| Market Sentiment | Both BTC and ETH are often influenced by the same market sentiment, such as regulatory news, technological advancements, or macroeconomic factors. |

| Supply and Demand | The supply and demand dynamics for both cryptocurrencies are interconnected, as they are both part of the broader cryptocurrency market. |

| Network Effects | The growing adoption of both BTC and ETH contributes to their correlation, as more users and investors tend to invest in both. |

However, it’s important to note that while there is a strong positive correlation between BTC and ETH, it is not absolute. There have been instances where the two cryptocurrencies have moved independently of each other, often due to specific events or developments affecting one of them more than the other.

Technological Differences and Impact on Correlation

Despite their similarities, BTC and ETH have distinct technological differences that can impact their correlation. BTC operates on a proof-of-work (PoW) consensus mechanism, while ETH is transitioning to a proof-of-stake (PoS) mechanism. These differences can lead to varying levels of network congestion, transaction fees, and energy consumption, which may influence their correlation:

-

Network Congestion: BTC’s PoW mechanism can lead to higher network congestion and transaction fees, which may affect its price and correlation with ETH.

-

Transaction Fees: The transaction fees for BTC and ETH can vary significantly, which may impact their correlation, especially during times of high network congestion.

-

Energy Consumption: BTC’s PoW mechanism requires a significant amount of energy, which has raised concerns about its environmental impact. ETH’s transition to PoS aims to reduce energy consumption, which may affect its correlation with BTC.

Market Events and Correlation

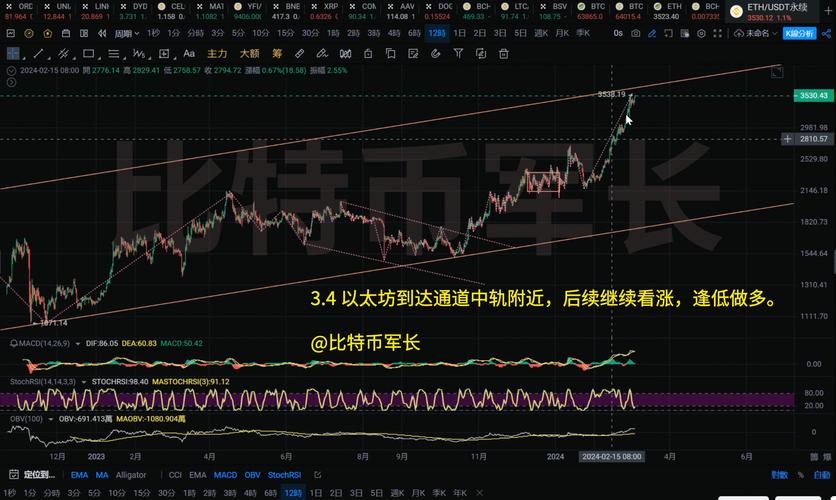

Market events can also play a crucial role in the correlation between BTC and ETH. For example, during the 2017 bull run, both cryptocurrencies experienced significant growth, leading to a strong positive correlation. Similarly, during the 2020-2021 bull run, BTC and ETH both reached all-time highs, further reinforcing their correlation.

However, certain events can lead to a divergence in the correlation between BTC and ETH. For instance, regulatory news or technological advancements that specifically impact one cryptocurrency may lead to a temporary decoupling from the other. An example of this is the Ethereum 2.0 upgrade, which has been a significant driver of ETH’s price and correlation with BTC.

Conclusion

In conclusion, the correlation between BTC and ETH is a multifaceted topic that can be influenced by various factors, including market dynamics, technological differences, and specific market events. While there is a strong positive correlation between the two cryptocurrencies, it is not absolute and can be influenced by various external factors. Understanding these factors can help investors make more informed decisions when trading or investing in BTC and ETH.