Does ETH Have a Cap?

When discussing Ethereum (ETH), one of the most frequently asked questions revolves around whether or not it has a cap. Ethereum, as a decentralized platform, has been a cornerstone of the blockchain revolution. Understanding its potential limitations is crucial for investors and enthusiasts alike. Let’s delve into this topic from various dimensions.

Understanding Ethereum’s Supply Cap

Ethereum’s supply cap is a significant factor that investors often consider. Unlike Bitcoin, which has a fixed supply cap of 21 million coins, Ethereum does not have a predetermined maximum supply. This is due to the nature of Ethereum’s proof-of-stake (PoS) consensus mechanism, which allows for inflationary growth.

Under the PoS mechanism, new ETH is created through staking, where validators are rewarded for securing the network. This process is designed to mimic the natural inflationary cycle of fiat currencies. As of now, Ethereum’s inflation rate is around 4.8% annually, but this rate is expected to decrease over time as the network transitions to PoS.

Ethereum’s Inflation Rate

As mentioned earlier, Ethereum’s inflation rate is currently around 4.8% annually. However, this rate is expected to decrease as the network transitions to PoS. According to Ethereum’s roadmap, the inflation rate will eventually stabilize at around 1.7% once the network reaches full PoS functionality.

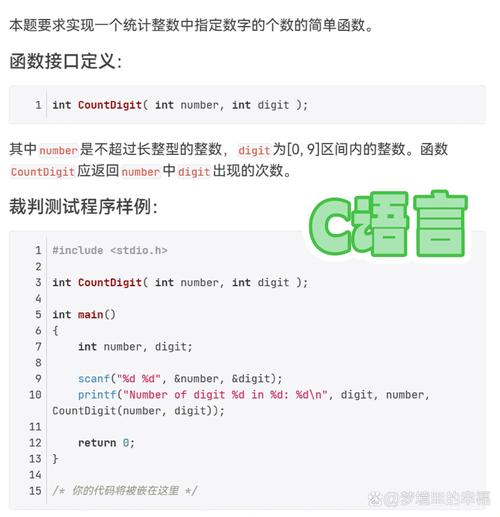

Here’s a table showcasing Ethereum’s inflation rate over the years:

| Year | Inflation Rate |

|---|---|

| 2020 | 4.8% |

| 2021 | 4.8% |

| 2022 | 4.8% |

| 2023 | 4.8% |

| 2024 | 1.7% |

Ethereum’s Market Cap and Price

Ethereum’s market cap and price are influenced by various factors, including supply, demand, and overall market sentiment. While Ethereum does not have a supply cap, its market cap and price can still be affected by the total number of ETH in circulation.

As of now, the total supply of ETH is over 120 million coins. However, the actual circulating supply is lower due to various factors, such as locked ETH in smart contracts and staked ETH. This means that the actual supply of ETH available for trading is less than the total supply.

Ethereum’s Future

Ethereum’s future remains uncertain, but there are several factors that could impact its growth and potential. One of the most significant developments is the transition to PoS, which is expected to improve scalability and reduce energy consumption.

Additionally, Ethereum’s ecosystem continues to expand, with new decentralized applications (dApps) and projects being developed on the platform. This growth could further increase demand for ETH, potentially driving up its price.

Conclusion

In conclusion, while Ethereum does not have a supply cap, its market cap and price can still be influenced by various factors. Understanding the dynamics of Ethereum’s supply, inflation rate, and market conditions is crucial for investors and enthusiasts alike. As the network continues to evolve, it’s essential to stay informed about the latest developments and trends.