Understanding the ETF ETH Approval Today: A Comprehensive Guide

Are you curious about the latest developments in the cryptocurrency market? If so, you’ve come to the right place. Today, we’re diving deep into the approval of the Ethereum Trust (ETF ETH) and exploring its implications. Let’s break down the details and understand what this means for investors and the crypto community.

What is the Ethereum Trust (ETF ETH)?

The Ethereum Trust, also known as ETF ETH, is a financial product designed to track the price of Ethereum, one of the most popular cryptocurrencies in the world. By investing in this ETF, investors can gain exposure to Ethereum without having to directly purchase and store the digital asset.

Why is the Approval Significant?

The approval of the ETF ETH is a significant milestone for the cryptocurrency market. It signifies that traditional financial institutions are increasingly recognizing the potential of digital assets. This approval could lead to a surge in institutional investment and potentially drive the price of Ethereum higher.

How Does the Approval Process Work?

The approval process for the ETF ETH involves several steps. First, the ETF sponsor must submit a proposal to the relevant regulatory authority, in this case, the U.S. Securities and Exchange Commission (SEC). The proposal outlines the details of the ETF, including its investment strategy, risk management measures, and governance structure.

Once the proposal is submitted, the SEC reviews it to ensure compliance with securities laws and regulations. This review process can take several months, and the SEC may request additional information or impose conditions on the approval. If the ETF meets all the requirements, the SEC grants approval, allowing the ETF to begin trading.

Impact on the Cryptocurrency Market

The approval of the ETF ETH is expected to have several positive impacts on the cryptocurrency market:

-

Institutional Investment: The ETF provides a regulated and secure way for institutional investors to gain exposure to Ethereum. This could lead to a significant influx of capital into the market, potentially driving up prices.

-

Market Confidence: The approval of the ETF ETH by the SEC sends a strong signal to the market that digital assets are gaining mainstream acceptance. This could boost investor confidence and attract more retail investors to the space.

-

Increased Liquidity: With the ETF ETH trading on major exchanges, it will provide increased liquidity for Ethereum. This could make it easier for investors to buy and sell the cryptocurrency, reducing volatility.

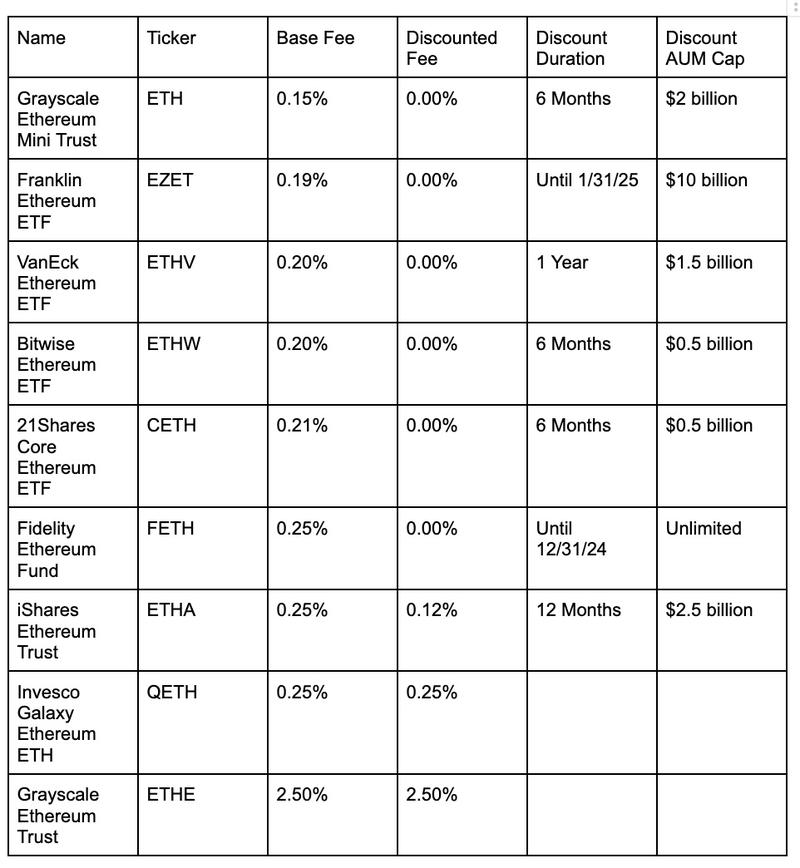

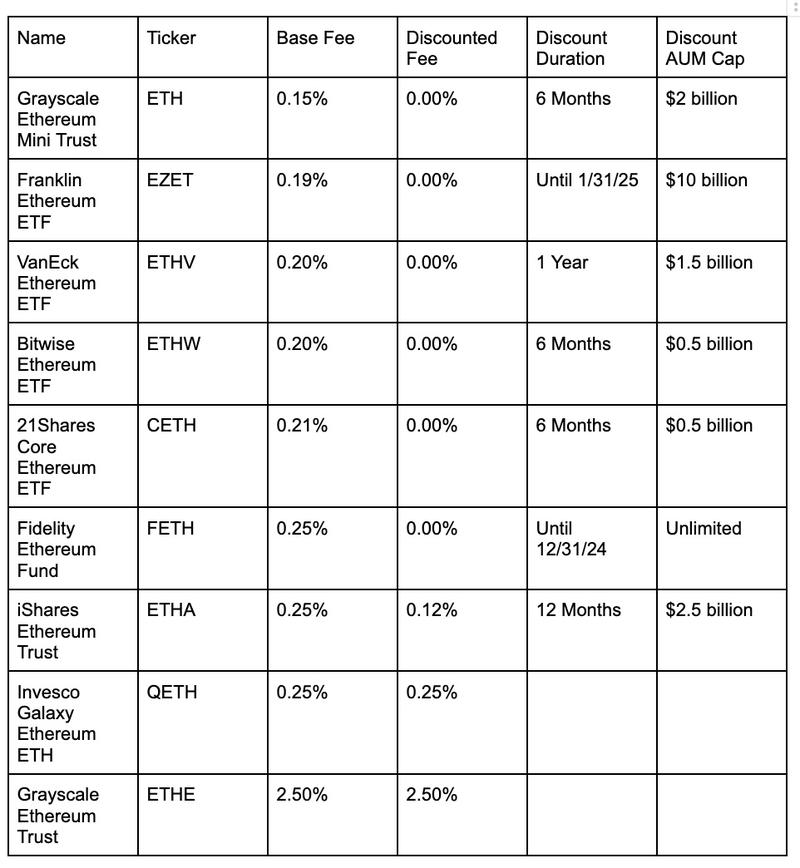

Comparison with Other Cryptocurrency ETFs

While the approval of the ETF ETH is a significant achievement, it’s important to compare it with other cryptocurrency ETFs. Here’s a brief overview of some key differences:

| Cryptocurrency ETF | Asset Tracked | Approval Status | Market Impact |

|---|---|---|---|

| BTC ETF | Bitcoin | Approved | Increased institutional investment, higher prices |

| ETH ETF | Ethereum | Approved | Increased institutional investment, higher prices |

| BNB ETF | Binance Coin | Pending Approval | Unclear, depends on regulatory decisions |

Conclusion

The approval of the Ethereum Trust (ETF ETH) is a significant development in the cryptocurrency market. It signifies the growing acceptance of digital assets by traditional financial institutions and could lead to increased investment and liquidity. As the market continues to evolve, it’s important for investors to stay informed and make informed decisions based on their own research and risk tolerance.