ETC and ETH: A Comprehensive Guide

When it comes to cryptocurrencies, two terms often come up more frequently than others: ETC and ETH. These two digital assets are part of the Ethereum network, but they have distinct characteristics and purposes. In this article, we will delve into the details of ETC and ETH, exploring their origins, functionalities, and the differences between them.

What is ETC?

Ethereum Classic (ETC) is a decentralized blockchain platform that was created as a result of a hard fork from the Ethereum network in 2016. The hard fork occurred due to a disagreement over how to handle a security breach that occurred on the Ethereum network. While Ethereum (ETH) moved forward with a new blockchain, ETC continued to operate on the original blockchain.

ETC retains the original Ethereum protocol and features, including smart contracts and decentralized applications (DApps). It aims to maintain the original vision of Ethereum, which is to create a decentralized platform that enables developers to build and deploy decentralized applications.

What is ETH?

Ethereum (ETH) is the native cryptocurrency of the Ethereum network. It is used to pay for transaction fees and to participate in the network’s governance. ETH is also a digital asset that can be bought, sold, and traded on various cryptocurrency exchanges.

The Ethereum network was designed to support smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code. This feature allows developers to create decentralized applications that can automate various processes, from simple transactions to complex financial instruments.

Origin and History

Ethereum was founded by Vitalik Buterin, a Russian-Canadian programmer, in 2013. The project quickly gained traction, and in 2014, the Ethereum Foundation was established to support the development and growth of the Ethereum network.

In 2016, a major security breach occurred on the Ethereum network, leading to a hard fork. The Ethereum Foundation proposed a solution to the problem, but a group of Ethereum community members disagreed with the proposed solution. This led to the creation of Ethereum Classic (ETC), which continued to operate on the original blockchain.

Technological Differences

One of the key differences between ETC and ETH is the consensus mechanism they use. ETC uses the Proof of Work (PoW) consensus mechanism, which is the same mechanism used by Bitcoin. ETH, on the other hand, is transitioning to the Proof of Stake (PoS) consensus mechanism, which is considered to be more energy-efficient and secure.

Another difference is the number of transactions that can be processed per second. ETC can handle around 25 transactions per second, while ETH can handle around 30 transactions per second. However, Ethereum is working on a scalability solution called Ethereum 2.0, which aims to increase the network’s transaction capacity to thousands of transactions per second.

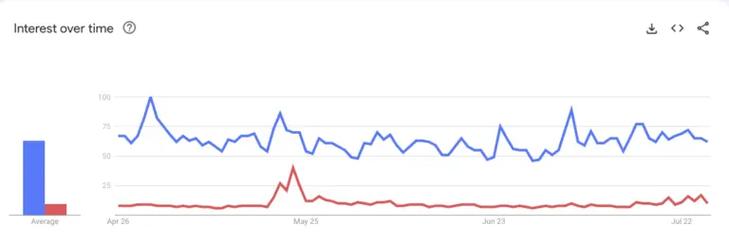

Market Performance

ETC and ETH have had different market performances over the years. ETC has maintained a relatively stable market position, while ETH has experienced significant volatility. This can be attributed to various factors, including regulatory news, technological advancements, and market sentiment.

As of the time of writing, ETC is valued at approximately $50, while ETH is valued at around $2,000. However, it is important to note that cryptocurrency markets are highly speculative, and prices can change rapidly.

Use Cases

ETC and ETH have different use cases within the cryptocurrency ecosystem. ETC is primarily used as a digital asset for investment and trading. It is also used to power decentralized applications and smart contracts on the ETC network.

ETH, on the other hand, is used as a medium of exchange, a store of value, and a tool for participation in the Ethereum network’s governance. It is also used to pay for transaction fees and to deploy DApps on the Ethereum network.

Conclusion

ETC and ETH are two distinct digital assets that are part of the Ethereum network. While they share some similarities, such as their origins and technological foundations, they also have distinct characteristics and purposes. Understanding the differences between ETC and ETH can help you make informed decisions when investing in or using these cryptocurrencies.

| Feature | ETC | ETH |

|---|---|---|

| Consensus Mechanism | Proof of Work (PoW) | Proof of Stake (Po

Related Stories |