Understanding Current Support and Resistance for ETH

When it comes to trading Ethereum (ETH), understanding the current support and resistance levels is crucial. These levels can help you make informed decisions about buying, selling, or holding your ETH. In this article, we will delve into the details of support and resistance for ETH, providing you with a comprehensive overview.

What is Support and Resistance?

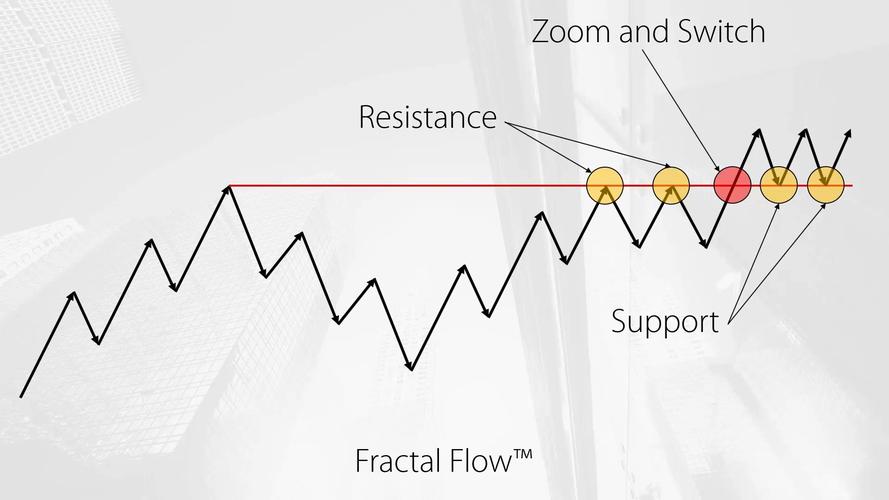

Support and resistance are key concepts in technical analysis, which is a method used to predict future price movements based on past price movements and trading volumes. Support levels are the price points at which a security’s price has a tendency to find a floor, or stop falling. Conversely, resistance levels are the price points at which a security’s price has a tendency to find a ceiling, or stop rising.

Support levels are typically identified by looking at previous price lows, while resistance levels are identified by looking at previous price highs. These levels can change over time as market conditions evolve.

Identifying Support and Resistance for ETH

When it comes to ETH, there are several ways to identify support and resistance levels:

-

Historical Price Data: Analyze past price charts to identify where the price has repeatedly found support or resistance.

-

Technical Indicators: Use technical indicators such as moving averages, Fibonacci retracement levels, and Bollinger Bands to identify potential support and resistance levels.

-

Market Sentiment: Keep an eye on market sentiment and news that could impact ETH’s price, as these factors can influence support and resistance levels.

Let’s take a look at some of the current support and resistance levels for ETH:

| Support Level | Resistance Level |

|---|---|

| $1,800 | $2,200 |

| $1,600 | $2,000 |

| $1,400 | $1,800 |

These levels are based on historical price data and technical analysis. However, it’s important to note that these levels can change as market conditions evolve.

Using Support and Resistance in Trading

Understanding support and resistance levels can help you make more informed trading decisions. Here are some strategies you can use:

-

Buy at Support: If the price of ETH reaches a support level, it may be a good opportunity to buy, as the price is likely to find a floor and start rising.

-

Sell at Resistance: If the price of ETH reaches a resistance level, it may be a good opportunity to sell, as the price is likely to find a ceiling and start falling.

-

Breakout and Breakdown: If the price of ETH breaks above a resistance level or below a support level, it may indicate a strong trend in one direction. In this case, you can consider taking a position in the direction of the trend.

It’s important to remember that these strategies are not foolproof and that trading involves risk. Always do your own research and consider your risk tolerance before making any trading decisions.

Conclusion

Understanding the current support and resistance levels for ETH is essential for making informed trading decisions. By analyzing historical price data, technical indicators, and market sentiment, you can identify potential support and resistance levels. Use these levels to inform your trading strategies, but always remember to do your own research and consider your risk tolerance.