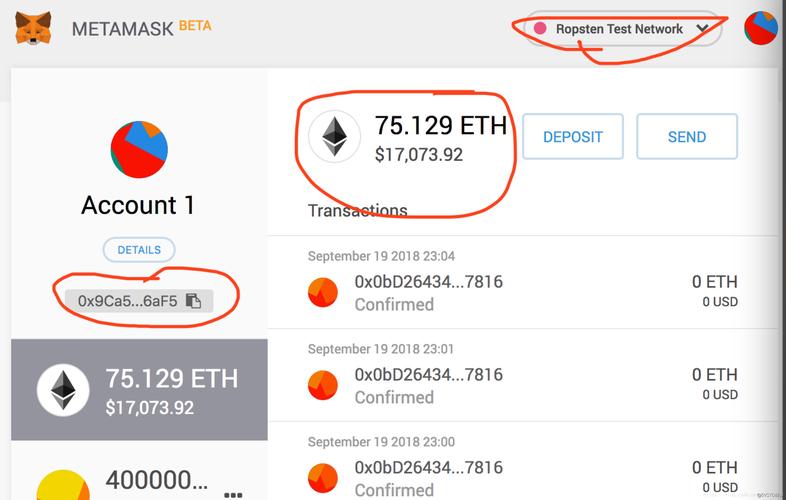

Understanding the Exchange Rate: 0.3683686 ETH to USD

When it comes to cryptocurrency trading, one of the most crucial aspects to understand is the exchange rate. In this article, we will delve into the details of the current exchange rate between Ethereum (ETH) and the United States Dollar (USD), which stands at 0.3683686. We will explore various dimensions, including historical trends, market factors, and practical implications for traders and investors.

Historical Exchange Rate Trends

Over the past few years, the exchange rate between ETH and USD has experienced significant fluctuations. To gain a better understanding of the current rate, let’s take a look at some historical data.

| Year | ETH to USD Exchange Rate |

|---|---|

| 2017 | ~$1,000 |

| 2018 | ~$300 |

| 2019 | ~$200 |

| 2020 | ~$600 |

| 2021 | ~$4,000 |

| 2022 | ~$2,000 |

As you can see from the table above, the exchange rate has experienced a remarkable surge in recent years, reaching an all-time high of around $4,000 in 2021. However, it has since experienced a significant decline, currently hovering around $2,000. This volatility is a characteristic of the cryptocurrency market, making it essential for traders and investors to stay informed and adapt to changing conditions.

Market Factors Influencing the Exchange Rate

Several factors contribute to the exchange rate between ETH and USD. Understanding these factors can help you make more informed decisions when trading or investing in Ethereum.

-

Supply and Demand: The fundamental principle of supply and demand plays a crucial role in determining the exchange rate. If there is a high demand for ETH and a limited supply, the price will increase. Conversely, if there is a surplus of ETH in the market, the price will decrease.

-

Market Sentiment: The overall sentiment of the market can significantly impact the exchange rate. Positive news, such as partnerships with major companies or regulatory approvals, can lead to an increase in the price. On the other hand, negative news, such as security breaches or regulatory crackdowns, can cause the price to plummet.

-

Market Trends: Identifying trends in the market can help you predict future price movements. For example, if the market is experiencing a bull run, you may expect the price of ETH to increase. Conversely, if the market is in a bearish trend, the price may decline.

-

Global Economic Factors: Economic factors, such as inflation rates, interest rates, and currency fluctuations, can also influence the exchange rate between ETH and USD. For instance, if the USD strengthens against other currencies, it may lead to a decrease in the ETH price.

Practical Implications for Traders and Investors

Understanding the exchange rate between ETH and USD can have several practical implications for traders and investors.

-

Position Sizing: Knowing the current exchange rate allows you to determine the appropriate position size for your trades. This is crucial to manage risk and maximize potential returns.

-

Market Timing: By analyzing historical data and market trends, you can make more informed decisions about when to enter or exit the market. This can help you capitalize on price movements and minimize losses.

-

Risk Management: Understanding the exchange rate can help you implement effective risk management strategies, such as setting stop-loss and take-profit levels.

-

Investment Opportunities: The current exchange rate