0002625 ETH/USD: A Comprehensive Overview

When it comes to cryptocurrency trading, the ETH/USD pair, also known as 0002625, is one of the most popular and widely-traded pairs in the market. In this article, we will delve into the various aspects of this pair, including its history, current market conditions, trading strategies, and future prospects.

History of ETH/USD

The ETH/USD pair was introduced in 2015, shortly after the Ethereum network was launched. Since then, it has grown to become one of the most liquid and actively traded cryptocurrency pairs. The pair’s value has seen significant fluctuations over the years, reflecting the volatility inherent in the cryptocurrency market.

Current Market Conditions

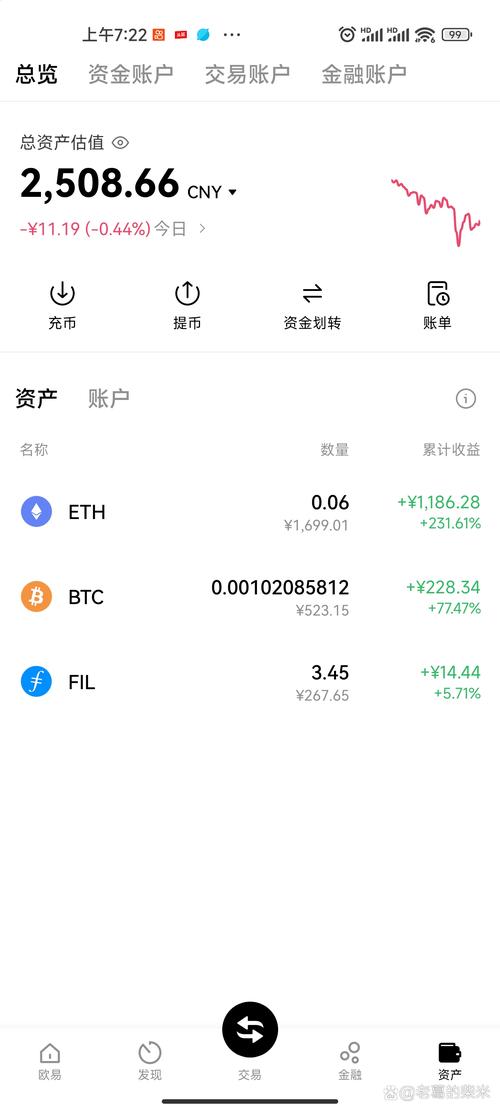

As of the latest data, the ETH/USD pair is trading at approximately $2,000. This represents a significant increase from its all-time low of around $100 in early 2018. The current market conditions are influenced by several factors, including global economic trends, regulatory news, and technological advancements in the blockchain space.

| Factor | Impact |

|---|---|

| Global Economic Trends | Positive economic conditions tend to boost investor confidence, leading to increased demand for cryptocurrencies. |

| Regulatory News | Positive regulatory news can lead to increased adoption and investment in cryptocurrencies, while negative news can have the opposite effect. |

| Technological Advancements | Innovations in blockchain technology can drive interest in cryptocurrencies and increase their value. |

Trading Strategies

Trading the ETH/USD pair requires a solid understanding of the market and a well-defined trading strategy. Here are some common trading strategies used by traders:

-

Day Trading: This involves buying and selling ETH/USD within the same day to profit from short-term price movements.

-

Swing Trading: This strategy focuses on capturing medium-term price movements by holding positions for several days or weeks.

-

Position Trading: This involves holding positions for an extended period, often months or even years, to benefit from long-term price trends.

Future Prospects

The future of the ETH/USD pair is uncertain, but there are several factors that could influence its performance:

-

Adoption of Ethereum: As more businesses and developers adopt Ethereum’s blockchain technology, demand for ETH could increase, driving up its price.

-

Regulatory Environment: A favorable regulatory environment could lead to increased adoption and investment in cryptocurrencies, benefiting the ETH/USD pair.

-

Technological Advancements: Innovations in blockchain technology could drive interest in Ethereum and its native cryptocurrency, ETH.

In conclusion, the ETH/USD pair, also known as 0002625, is a popular and highly-traded cryptocurrency pair. Understanding its history, current market conditions, trading strategies, and future prospects can help you make informed decisions when trading this pair. As always, remember to do your own research and consult with a financial advisor before making any investment decisions.