Bitcoin vs. Ethereum: A Comprehensive Comparison

When it comes to cryptocurrencies, Bitcoin and Ethereum are two of the most well-known and influential digital assets. Both have their unique features and advantages, making them popular choices for investors and users alike. In this article, we will delve into a multi-dimensional comparison of Bitcoin and Ethereum, covering aspects such as their origins, technology, market performance, and use cases.

Origins and Founders

Bitcoin, often referred to as the “gold standard” of cryptocurrencies, was created by an anonymous person or group of people using the pseudonym Satoshi Nakamoto in 2009. It was the first decentralized digital currency, aiming to provide a secure and transparent means of exchange without the need for intermediaries like banks.

Ethereum, on the other hand, was founded by Vitalik Buterin in 2015. It was designed to be a platform for building decentralized applications (DApps) and smart contracts, allowing developers to create innovative projects on top of the Ethereum network.

Technology and Blockchain

Bitcoin and Ethereum both operate on blockchain technology, a decentralized ledger that records transactions across multiple computers. However, there are some key differences in their underlying technologies.

Bitcoin’s blockchain is primarily focused on serving as a digital currency. It uses a proof-of-work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to validate transactions and add them to the blockchain. This process requires significant computational power and energy consumption.

Ethereum, on the other hand, has evolved from its original PoW consensus mechanism to a proof-of-stake (PoS) mechanism. PoS aims to be more energy-efficient and requires validators to lock up a certain amount of Ethereum as collateral to participate in the consensus process. Ethereum also introduced the concept of smart contracts, allowing developers to create self-executing contracts with the terms directly written into code.

Market Performance

Both Bitcoin and Ethereum have experienced significant growth since their inception. However, their market performance has varied over time.

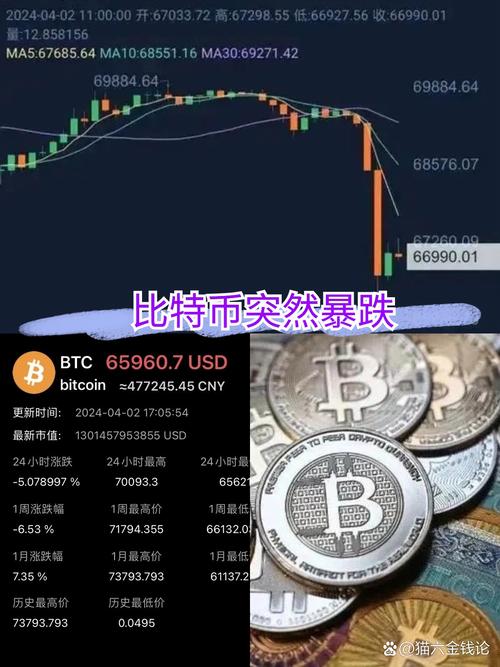

Bitcoin has been the dominant cryptocurrency since its launch, often referred to as “digital gold.” It has seen massive price increases and has become a popular investment asset. However, it has also experienced periods of volatility and price corrections.

Ethereum, while younger than Bitcoin, has gained significant traction in the blockchain space. It has become the leading platform for DApps and smart contracts, attracting a large community of developers. Ethereum has also seen substantial growth in its market capitalization, although it has faced challenges and price fluctuations similar to Bitcoin.

Use Cases

Bitcoin and Ethereum have different primary use cases, which contribute to their distinct roles in the cryptocurrency ecosystem.

Bitcoin is primarily used as a digital currency and a store of value. It offers a decentralized and secure means of transferring funds across borders without the need for intermediaries. Bitcoin’s limited supply of 21 million coins has made it attractive to investors seeking a digital asset with scarcity.

Ethereum, on the other hand, is a platform for building decentralized applications and smart contracts. It enables developers to create innovative projects ranging from decentralized finance (DeFi) to supply chain management and gaming. Ethereum’s smart contracts allow for automated and trustless transactions, making it a powerful tool for various industries.

Conclusion

In conclusion, Bitcoin and Ethereum are two of the most influential cryptocurrencies, each with its unique features and advantages. Bitcoin’s focus on digital currency and its position as the first cryptocurrency have made it a popular choice for investors and users. Ethereum, on the other hand, has gained traction as a platform for building decentralized applications and smart contracts, attracting a large community of developers. Understanding the differences between these two cryptocurrencies can help individuals make informed decisions when considering their investment and use cases.