Understanding 1 ETH: A Comprehensive Overview

When diving into the world of cryptocurrencies, Ethereum (ETH) stands out as one of the most prominent and influential digital assets. With a market capitalization that has seen significant fluctuations over the years, understanding the value and dynamics of 1 ETH is crucial for anyone interested in the crypto space. Let’s explore the various dimensions of 1 ETH, from its historical price movements to its current market standing.

Historical Price Movements

Ethereum was launched in July 2015, and since then, its price has experienced dramatic ups and downs. Initially, 1 ETH was worth just a few cents. However, as the cryptocurrency market matured, the value of ETH skyrocketed. In 2017, during the ICO boom, 1 ETH reached an all-time high of nearly $1,400. Since then, it has seen several bull and bear markets, with its value fluctuating between $100 and $5,000.

| Year | Price of 1 ETH |

|---|---|

| 2015 | $0.30 – $2.00 |

| 2016 | $10.00 – $20.00 |

| 2017 | $100.00 – $1,400.00 |

| 2018 | $100.00 – $300.00 |

| 2019 | $100.00 – $500.00 |

| 2020 | $200.00 – $5,000.00 |

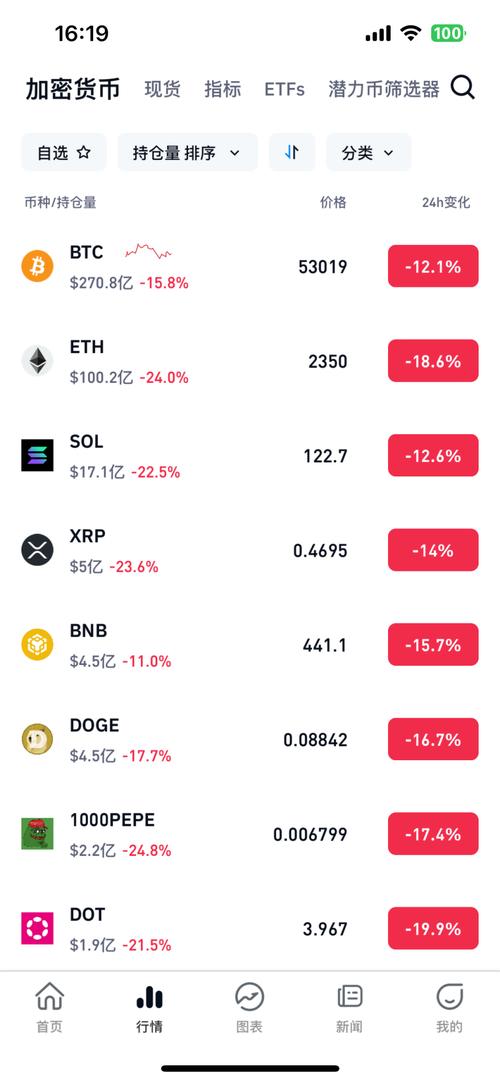

Market Capitalization

Market capitalization is a critical metric for evaluating the value of a cryptocurrency. As of the latest data, Ethereum has a market capitalization of over $200 billion, making it the second-largest cryptocurrency by market cap, trailing only Bitcoin. This significant market cap reflects the widespread adoption and trust in the Ethereum network.

Supply and Distribution

Ethereum has a maximum supply of 18 million ETH, which is significantly lower than Bitcoin’s 21 million. This limited supply has contributed to the asset’s value and scarcity. The distribution of ETH is also unique, with a significant portion held by early investors and developers. According to CoinMarketCap, the top 100 addresses hold approximately 20% of the total supply, while the remaining 80% is spread across millions of users.

Use Cases and Applications

Ethereum is not just a digital asset; it is a platform that enables the creation and deployment of decentralized applications (dApps) and smart contracts. This has opened up a wide range of use cases, from decentralized finance (DeFi) to supply chain management and more. The versatility of the Ethereum network has attracted developers and investors from various industries, further driving its value.

Network Performance

The performance of the Ethereum network is a crucial factor in determining its value. The network’s ability to handle transactions, its security, and its scalability all play a role in its overall performance. Ethereum has faced challenges in the past, such as the 2016 DAO attack and the 2021 Merge upgrade, which aimed to improve the network’s efficiency and reduce its environmental impact. Despite these challenges, Ethereum remains a robust and reliable platform.

Regulatory Environment

The regulatory environment surrounding cryptocurrencies is constantly evolving, and Ethereum is no exception. Governments and regulatory bodies around the world are still trying to figure out how to regulate this emerging asset class. The regulatory landscape can significantly impact the value and adoption of ETH, so it’s essential to stay informed about any changes in the legal framework.

Conclusion

Understanding the value and dynamics of 1 ETH requires examining various dimensions, from its historical price movements and market capitalization to its supply and distribution, use cases, network performance, and regulatory environment. By considering these factors, you can gain a comprehensive understanding of Ethereum’s value and its potential for future growth.