3.41144087 ETH: A Comprehensive Overview

When it comes to cryptocurrencies, Ethereum (ETH) stands out as one of the most popular and influential digital assets. With a market capitalization that has seen significant fluctuations over the years, understanding the intricacies of ETH is crucial for anyone looking to invest or simply stay informed about the crypto space. In this article, we delve into the details of 3.41144087 ETH, exploring its value, market trends, and potential future developments.

Understanding Ethereum (ETH)

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. The native cryptocurrency of the Ethereum network is ETH, which is used to pay for transaction fees and to incentivize network participants.

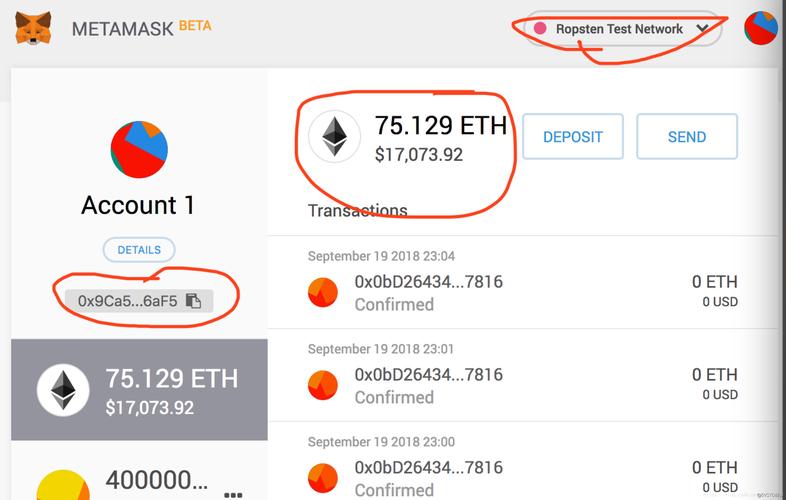

Market Value of 3.41144087 ETH

As of the latest available data, the market value of 3.41144087 ETH can be calculated by multiplying the current ETH price by the amount of ETH in question. For instance, if the current price of ETH is $2,000, then the market value of 3.41144087 ETH would be approximately $6,822.88. Keep in mind that this value is subject to change as the price of ETH fluctuates in the market.

Market Trends

Over the years, the price of ETH has experienced significant volatility. In 2017, the cryptocurrency saw a meteoric rise, reaching an all-time high of nearly $2,000. However, it has since faced several challenges, including regulatory concerns and competition from other blockchain projects. As of this writing, the price of ETH has stabilized, but it remains susceptible to market fluctuations.

| Year | ETH Price (USD) | Market Cap (USD) |

|---|---|---|

| 2015 | $0.30 | $0 |

| 2016 | $10.50 | $0 |

| 2017 | $2,000 | $100 billion |

| 2018 | $300 | $20 billion |

| 2021 | $4,000 | $200 billion |

As seen in the table above, the market value of ETH has seen significant growth over the years, but it has also faced periods of decline. It is important to note that the market trends of ETH are influenced by various factors, including technological advancements, regulatory news, and overall market sentiment.

Factors Influencing ETH Price

Several factors can influence the price of ETH, including:

-

Supply and demand: The supply of ETH is limited, as the network has a maximum supply of 18 million ETH. However, the demand for ETH can fluctuate based on market trends and the popularity of DApps built on the Ethereum network.

-

Technological developments: The Ethereum network is continuously evolving, with new updates and improvements being implemented. These developments can positively or negatively impact the price of ETH, depending on the market’s perception of the changes.

-

Regulatory news: Governments around the world are still figuring out how to regulate cryptocurrencies. Any news regarding regulations can have a significant impact on the price of ETH.

-

Market sentiment: The overall sentiment in the cryptocurrency market can influence the price of ETH. For example, if the market is bullish, ETH prices may rise, and vice versa.

Potential Future Developments

The Ethereum network is currently undergoing a major upgrade known as Ethereum 2.0. This upgrade aims to improve scalability, reduce transaction fees, and make the network more energy-efficient. If successful, Ethereum 2.0 could significantly impact