Best ETH Staking Rate: A Comprehensive Guide

Staking Ethereum (ETH) has become an increasingly popular way for investors to earn passive income. With the rise of decentralized finance (DeFi) and the growing interest in blockchain technology, many are looking for the best staking rates to maximize their returns. In this article, we will delve into the various aspects of ETH staking, including the best rates, platforms, and strategies to help you make informed decisions.

Understanding ETH Staking

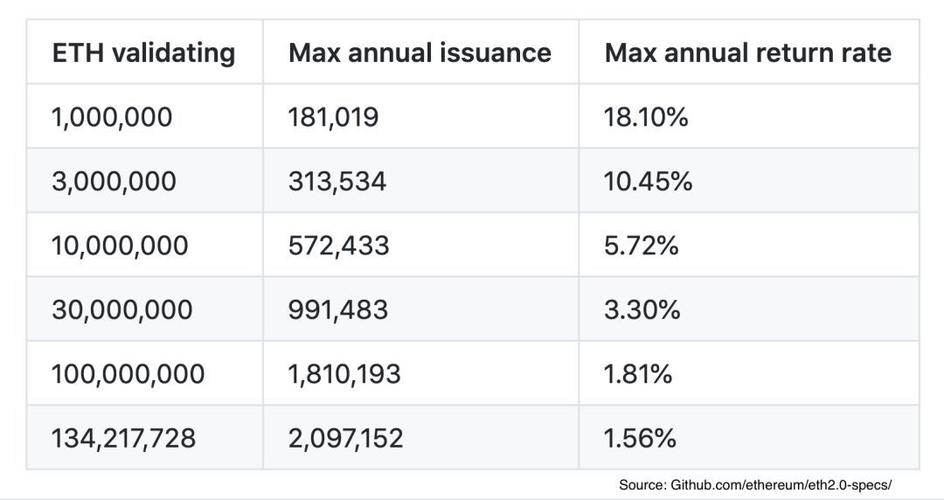

Ethereum staking is a process where you lock up your ETH tokens to support the Ethereum network and earn rewards in return. By becoming a validator, you help secure the network and ensure its smooth operation. The more ETH you stake, the higher your chances of earning rewards, as well as the potential to earn more rewards.

Best ETH Staking Rates

As of the latest data available, the best ETH staking rates vary depending on the platform you choose. Here is a breakdown of some of the top platforms and their respective staking rates:

| Platform | Staking Rate | Minimum Stake |

|---|---|---|

| MyEtherWallet (MEW) | 4.5% – 5% | 32 ETH |

| Ethermine | 4.5% – 5% | 32 ETH |

| Lido Finance | 4.5% – 5% | 32 ETH |

| Staked | 4.5% – 5% | 32 ETH |

| InfStones | 4.5% – 5% | 32 ETH |

It’s important to note that these rates are subject to change and can vary based on the platform’s specific terms and conditions. Additionally, some platforms may offer higher rates for larger stakes or for a limited time.

Choosing the Right Platform

Selecting the right platform for ETH staking is crucial to maximize your returns. Here are some factors to consider when choosing a platform:

- Staking Rate: As mentioned earlier, the staking rate is a significant factor in determining your potential returns. Compare the rates offered by different platforms to find the best deal.

- Minimum Stake: Some platforms require a higher minimum stake to participate in staking. Ensure that you have enough ETH to meet the minimum requirement.

- Security: Choose a platform with a strong track record of security and reliability. Look for platforms that have undergone audits and have a good reputation in the community.

- Usability: Consider the ease of use and user interface of the platform. A user-friendly platform can make the staking process more enjoyable and less stressful.

Strategies for Maximizing ETH Staking Returns

Once you have chosen a platform and started staking your ETH, there are several strategies you can employ to maximize your returns:

- Stake for Longer Periods: Staking your ETH for longer periods can increase your chances of earning more rewards. However, be sure to research the lock-up periods and withdrawal fees associated with your chosen platform.

- Stay Informed: Keep up with the latest news and developments in the Ethereum ecosystem. This can help you make informed decisions about your staking strategy.

- Use Liquidity Pools: Some platforms offer liquidity pools where you can lend your ETH to earn additional rewards. However, be cautious and do thorough research before participating in liquidity pools.

Conclusion

Staking Ethereum can be a lucrative way to earn passive income. By understanding the best ETH staking rates, choosing the right platform, and employing effective strategies, you can maximize your returns. Always do your research and stay informed to make the best decisions for your investment portfolio.