aave eth merge

Are you curious about the aave eth merge? If so, you’ve come to the right place. In this article, we will delve into the details of this intriguing process, exploring its implications, benefits, and the potential future of DeFi. Let’s dive in.

Understanding the aave eth merge

The aave eth merge refers to the integration of Ethereum (ETH) with the Aave protocol. Aave is a decentralized lending and borrowing platform that allows users to earn interest on their deposits and borrow assets without the need for intermediaries. Ethereum, on the other hand, is a blockchain platform that supports smart contracts and decentralized applications (DApps).

By merging Ethereum with Aave, users can now access the benefits of both platforms. This integration aims to enhance the overall user experience, increase liquidity, and expand the capabilities of the Aave protocol.

The benefits of the aave eth merge

1. Increased liquidity: The merge of Ethereum with Aave will lead to increased liquidity in the Aave protocol. This means that users will have access to a wider range of assets to borrow and lend, resulting in lower interest rates and improved borrowing terms.

2. Enhanced user experience: By integrating Ethereum, Aave will offer a more seamless and user-friendly experience. Users will be able to interact with the platform using familiar Ethereum-based wallets and DApps.

3. Improved security: The merge will leverage the robust security features of Ethereum, ensuring that users’ assets are protected against potential threats.

4. Cross-chain compatibility: The integration of Ethereum with Aave will enable cross-chain compatibility, allowing users to interact with other blockchain platforms and DApps seamlessly.

The technical aspects of the aave eth merge

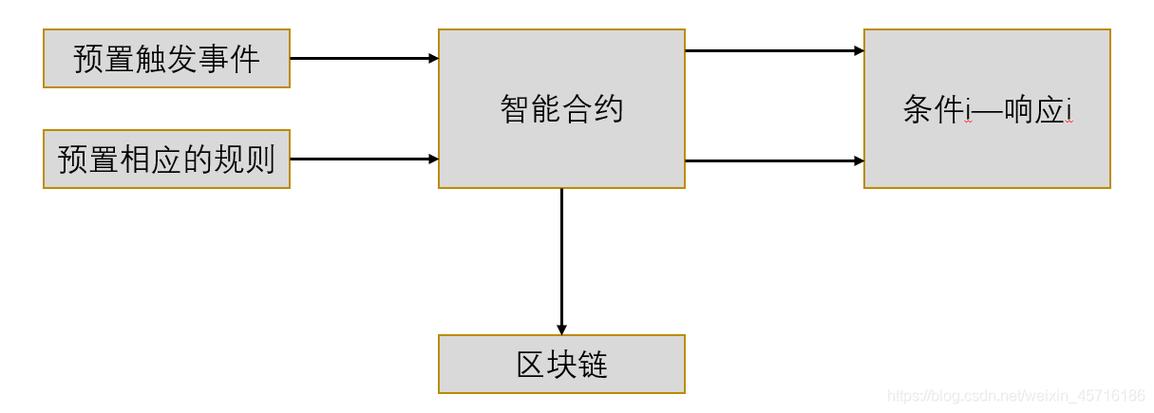

1. Smart contracts: The aave eth merge relies heavily on smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts will facilitate the lending and borrowing process on the Aave platform.

2. Ethereum Virtual Machine (EVM): The integration of Ethereum with Aave will require the use of the Ethereum Virtual Machine (EVM), which is a runtime environment for executing smart contracts. This will ensure that the Aave protocol is compatible with Ethereum-based DApps.

3. Cross-chain communication: To enable cross-chain compatibility, the aave eth merge will utilize cross-chain communication protocols, such as the Polkadot Interoperability Protocol (IP) or the Ethereum Layer 2 solutions.

The potential future of the aave eth merge

1. Expansion of DeFi: The aave eth merge is expected to drive the expansion of decentralized finance (DeFi) by providing a more robust and user-friendly platform for lending and borrowing. This could lead to increased adoption of DeFi services and products.

2. Increased competition: With the integration of Ethereum, Aave will face increased competition from other DeFi platforms. However, this competition may also drive innovation and improvements in the Aave protocol.

3. Regulatory challenges: As DeFi continues to grow, regulatory challenges may arise. The aave eth merge will need to navigate these challenges to ensure compliance with evolving regulations.

Table: Key features of the aave eth merge

| Feature | Description |

|---|---|

| Increased liquidity | Access to a wider range of assets for borrowing and lending |

| Enhanced user experience | Seamless interaction with the platform using Ethereum-based wallets and DApps |

| Improved security | Utilization of Ethereum’s robust security features |

| Cross-chain compatibility | Interaction with other blockchain platforms and DApps |

In conclusion, the aave eth merge is a significant development in the DeFi space. By integrating Ethereum with the Aave protocol, users can expect increased liquidity, enhanced user experience, improved security, and cross-chain compatibility. As DeFi continues to evolve, the aave eth merge may play a crucial role in shaping the future of decentralized finance.