Understanding AVAX and ETH: A Comprehensive Overview

When it comes to the world of cryptocurrencies, Ethereum (ETH) and Avalanche (AVAX) are two of the most prominent players. Both have their unique features and advantages, making them popular choices among investors and developers. In this article, we will delve into the details of AVAX and ETH, exploring their history, technology, market performance, and future prospects.

History and Technology

Ethereum, launched in 2015, was one of the first blockchain platforms to introduce smart contracts. It has since become the de facto standard for decentralized applications (DApps) and has a vast ecosystem of projects built on top of it. Ethereum’s native token, ETH, is used for transaction fees, staking, and governance.

Avalanche, on the other hand, was launched in 2020 and aims to be a more scalable and efficient alternative to Ethereum. It uses a unique consensus algorithm called Avalanche consensus, which allows for near-instant finality and high throughput. AVAX is the native token of the Avalanche network and is used for transaction fees, staking, and governance.

Market Performance

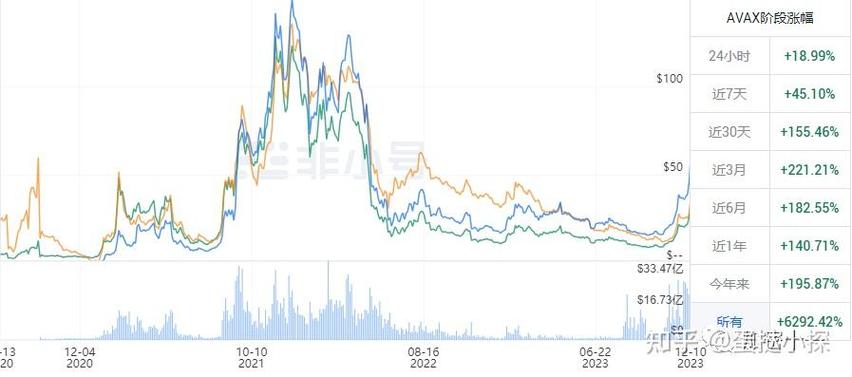

Over the years, both ETH and AVAX have seen significant growth in their market capitalization. Ethereum has been the dominant player in the smart contract space, and its market cap has reached over $200 billion. AVAX, while being a relatively new entrant, has also seen impressive growth, with a market cap of over $10 billion.

When comparing the performance of ETH and AVAX, it’s important to consider various factors. Ethereum has a larger user base and a more established ecosystem, which has contributed to its market dominance. However, AVAX has been gaining traction due to its superior technology and lower transaction fees.

Technology Comparison

One of the key differences between Ethereum and Avalanche is their underlying technology. Ethereum uses a proof-of-work (PoW) consensus algorithm, which requires a significant amount of computational power and energy. In contrast, Avalanche uses a proof-of-stake (PoS) consensus algorithm, which is more energy-efficient and allows for faster transaction speeds.

Here’s a table comparing some of the key technical aspects of Ethereum and Avalanche:

| Aspect | Ethereum | Avalanche |

|---|---|---|

| Consensus Algorithm | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

| Transaction Speed | 15-30 seconds | 2-3 seconds |

| Transaction Fees | Varies | Low |

| Energy Consumption | High | Low |

Future Prospects

The future of both ETH and AVAX looks promising, but there are some factors that could impact their growth. Ethereum is currently undergoing a major upgrade called Ethereum 2.0, which aims to improve scalability, security, and sustainability. If successful, this upgrade could further solidify Ethereum’s position as the leading smart contract platform.

Avalanche, on the other hand, has the potential to become a major competitor to Ethereum. Its superior technology and lower transaction fees make it an attractive option for developers and users. However, it will need to overcome challenges such as regulatory scrutiny and market competition.

Conclusion

Both Ethereum and Avalanche have their unique strengths and weaknesses, making them valuable assets in the cryptocurrency space. As the industry continues to evolve, it will be interesting to see how these two projects develop and what impact they will have on the future of blockchain technology.