Best Ratio for BTC to ETH: A Comprehensive Guide

Deciding on the best ratio for Bitcoin (BTC) to Ethereum (ETH) can be a complex task, especially considering the volatile nature of both cryptocurrencies. In this detailed guide, we will explore various factors that can help you determine the optimal ratio for your investment strategy.

Understanding the Market Dynamics

The cryptocurrency market is influenced by numerous factors, including technological advancements, regulatory news, and global economic conditions. To find the best ratio for BTC to ETH, it’s crucial to understand the dynamics that affect both currencies.

| Factor | Impact on BTC | Impact on ETH |

|---|---|---|

| Technological Developments | Positive news can lead to increased demand for BTC, potentially boosting its value. | Similarly, positive news about Ethereum’s technology can drive up its value. |

| Regulatory News | Regulatory news can significantly impact the market sentiment for both BTC and ETH. | However, the impact may vary depending on the country and the nature of the regulation. |

| Global Economic Conditions | During economic downturns, investors may turn to BTC as a safe haven, potentially increasing its value. | Ethereum’s value may also be affected by global economic conditions, but the correlation may not be as strong as with BTC. |

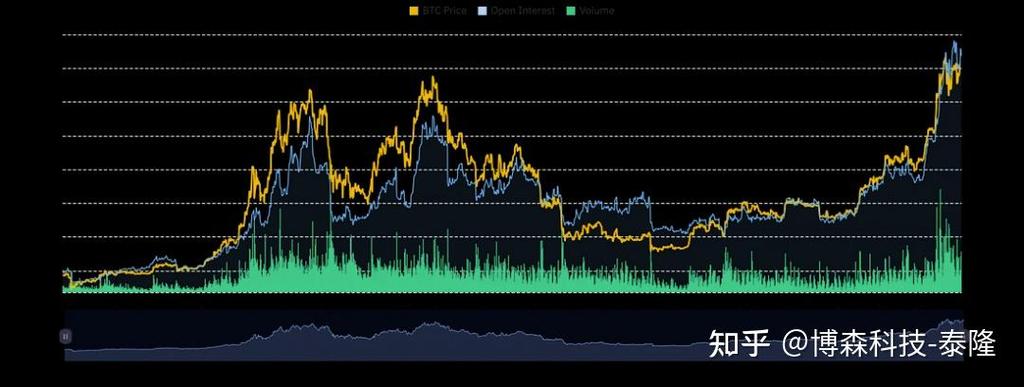

Historical Performance

Looking at the historical performance of BTC and ETH can provide insights into their correlation and potential future movements. Let’s take a look at some key data points.

Over the past few years, BTC and ETH have shown a strong positive correlation, meaning that when one currency increases in value, the other tends to do the same. However, the strength of this correlation can vary over time.

| Year | BTC to ETH Ratio | Market Cap Rank |

|---|---|---|

| 2017 | 1 BTC = 300 ETH | 1st and 2nd |

| 2018 | 1 BTC = 150 ETH | 1st and 2nd |

| 2019 | 1 BTC = 200 ETH | 1st and 2nd |

| 2020 | 1 BTC = 250 ETH | 1st and 2nd |

| 2021 | 1 BTC = 50 ETH | 1st and 2nd |

Market Sentiment

Market sentiment plays a significant role in determining the best ratio for BTC to ETH. Here are some factors that can influence market sentiment:

-

Media Coverage: Positive news about cryptocurrencies can boost market sentiment, while negative news can have the opposite effect.

-

Market Trends: Identifying trends in the market can help you make informed decisions about the best ratio for BTC to ETH.

-

Expert Opinions: Following the opinions of experienced traders and analysts can provide valuable insights into market sentiment.

Investment Strategy

Your investment strategy should be tailored to your risk tolerance, investment goals, and market analysis. Here are some tips to help you determine the best ratio for BTC to ETH:

-

Divide Your Portfolio: Allocate a portion of your portfolio to both BTC and ETH to diversify your investments.

-

Stay Informed: Keep up with the latest news and developments in the cryptocurrency market.

-

Use Technical Analysis: Analyze historical price charts and patterns to identify potential buying and