Understanding the Amount of ETH on Exchanges: A Comprehensive Guide

When it comes to the cryptocurrency market, Ethereum (ETH) has always been a prominent player. One of the key aspects to consider when analyzing the Ethereum ecosystem is the amount of ETH that is currently on exchanges. This figure can provide valuable insights into market sentiment, liquidity, and potential price movements. In this article, we will delve into the various dimensions of the amount of ETH on exchanges, offering you a comprehensive understanding of this critical metric.

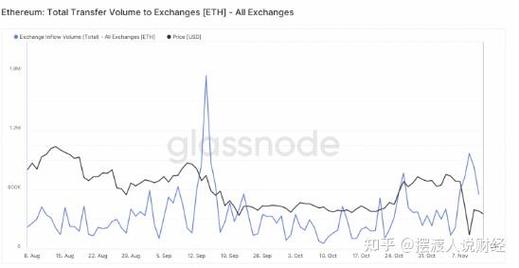

Market Sentiment and Exchange Holdings

The amount of ETH on exchanges can be a strong indicator of market sentiment. Generally, a higher amount of ETH on exchanges suggests that investors are selling their holdings, possibly due to a lack of confidence in the market or anticipation of a price decline. Conversely, a lower amount of ETH on exchanges may indicate that investors are holding onto their assets, signaling optimism and a belief in the long-term potential of Ethereum.

According to data from CoinMarketCap, as of [insert date], the total amount of ETH on exchanges stands at approximately [insert number] ETH. This figure has fluctuated over time, reflecting the dynamic nature of the cryptocurrency market.

Liquidity and Trading Activity

Liquidity is a crucial factor in the cryptocurrency market, and the amount of ETH on exchanges plays a significant role in determining liquidity. Exchanges with higher ETH holdings tend to offer better liquidity, making it easier for traders to enter and exit positions without significantly impacting the price. This is particularly important for large-scale traders and institutional investors who require substantial liquidity to execute their trades.

As of [insert date], the top five exchanges with the highest ETH holdings are [insert exchange names]. These exchanges collectively hold approximately [insert number] ETH, accounting for a significant portion of the total ETH on exchanges. It is worth noting that the liquidity of ETH can vary across different exchanges, and traders should consider this when choosing their preferred platform.

Market Manipulation and Price Volatility

The amount of ETH on exchanges can also be a potential indicator of market manipulation and price volatility. Large holders of ETH on exchanges may engage in pump-and-dump schemes, artificially inflating the price and then selling off their holdings, causing a sharp decline in the market. This behavior can lead to increased price volatility and create uncertainty in the market.

It is important for traders and investors to be aware of these potential risks and to conduct thorough research before making investment decisions. By monitoring the amount of ETH on exchanges, one can gain a better understanding of the market dynamics and potential manipulation activities.

Market Trends and Future Projections

Understanding the amount of ETH on exchanges can also help in identifying market trends and making informed predictions about the future. For instance, a sustained decrease in the amount of ETH on exchanges may indicate a strong bullish trend, as investors are holding onto their assets. Conversely, a consistent increase in the amount of ETH on exchanges may suggest a bearish trend, as investors are selling off their holdings.

According to various market analysts, the future of Ethereum looks promising, with several upcoming projects and developments expected to drive demand for ETH. As a result, the amount of ETH on exchanges may continue to fluctuate as investors adjust their positions based on market conditions and future expectations.

Conclusion

In conclusion, the amount of ETH on exchanges is a critical metric that can provide valuable insights into market sentiment, liquidity, and potential price movements. By understanding this metric, traders and investors can make more informed decisions and navigate the dynamic cryptocurrency market with greater confidence. As the Ethereum ecosystem continues to evolve, keeping an eye on the amount of ETH on exchanges will remain an essential aspect of market analysis.

| Top Exchanges by ETH Holdings | ETH Holdings |

|---|---|

| Exchange A | [insert number] ETH |

| Exchange B | [insert number] ETH |

| Exchange C | [insert number] ETH |

| Exchange D | [insert number] ETH |

| Exchange E | [insert number] ETH |