Understanding AVAX on ETH: A Comprehensive Guide

Are you curious about the intersection of AVAX and ETH? You’ve come to the right place. In this detailed guide, we’ll delve into what AVAX on ETH means, how it works, and its implications for the crypto world. Let’s dive in.

What is AVAX on ETH?

AVAX on ETH refers to the ability to trade and interact with AVAX tokens on the Ethereum network. AVAX is the native token of the Avalanche blockchain, a high-performance, high-throughput platform designed to enable decentralized applications and services. By bridging AVAX with ETH, users can access a wider range of decentralized finance (DeFi) applications and services.

How does AVAX on ETH work?

AVAX on ETH operates through a process called token bridging. This process involves transferring AVAX tokens from the Avalanche network to the Ethereum network, allowing users to interact with Ethereum-based applications and services. Here’s a step-by-step breakdown:

-

Users send AVAX tokens from the Avalanche network to a designated bridge contract on the Ethereum network.

-

The bridge contract verifies the transaction and locks the AVAX tokens, ensuring they are not double-spent.

-

The bridge contract then mints new AVAX tokens on the Ethereum network, representing the transferred AVAX tokens.

-

Users can now interact with Ethereum-based applications and services using the bridged AVAX tokens.

-

When users want to return to the Avalanche network, they can burn the bridged AVAX tokens on the Ethereum network, which will unlock the corresponding AVAX tokens on the Avalanche network.

Benefits of AVAX on ETH

There are several benefits to using AVAX on ETH:

-

Access to a wider range of DeFi applications: By bridging AVAX with ETH, users can access a vast array of DeFi applications and services on the Ethereum network, including lending, borrowing, and trading platforms.

-

Interoperability: AVAX on ETH promotes interoperability between different blockchains, allowing users to seamlessly transfer assets between networks.

-

Increased liquidity: The availability of AVAX on ETH increases the liquidity of the Avalanche network, making it easier for users to trade and interact with AVAX tokens.

-

Reduced transaction fees: By utilizing the Ethereum network, users can benefit from lower transaction fees compared to the Avalanche network.

Risks and Considerations

While AVAX on ETH offers numerous benefits, it’s essential to be aware of the risks and considerations:

-

Smart contract risks: The process of bridging tokens involves smart contracts, which can be vulnerable to bugs and exploits. Users should exercise caution and conduct thorough research before interacting with bridging contracts.

-

Network congestion: The Ethereum network can experience high levels of congestion, leading to increased transaction fees and slower processing times.

-

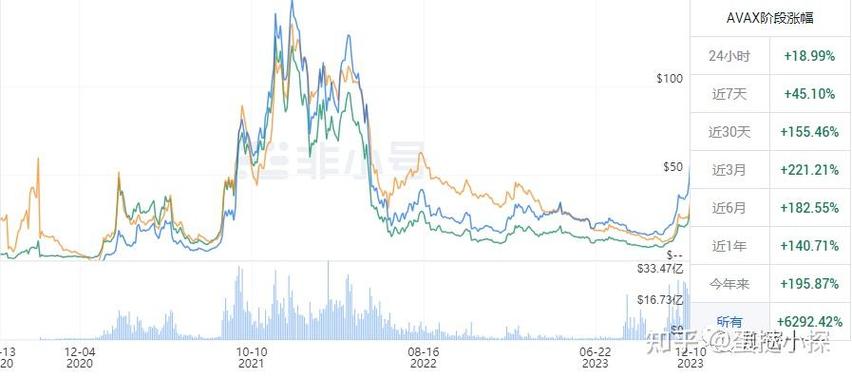

Token volatility: Both AVAX and ETH are highly volatile assets, and their prices can fluctuate significantly. Users should be prepared for potential losses.

Table: Comparison of AVAX and ETH

| Feature | AVAX | ETH |

|---|---|---|

| Network | Avalanche | Ethereum |

| Block Time | 3 seconds | 14-15 seconds |

| Transaction Fees | Lower | Higher |

| Market Capitalization | $2.5 billion | $200 billion |

Conclusion

AVAX on ETH represents a significant development in the crypto