Understanding Binance ETH Options: A Comprehensive Guide for You

Binance, the world’s leading cryptocurrency exchange, offers a wide range of trading options, including Ethereum options. If you’re considering trading ETH options on Binance, this detailed guide will provide you with all the necessary information to make informed decisions.

What are Binance ETH Options?

Binance ETH options are financial derivatives that allow you to speculate on the future price of Ethereum. By purchasing an option, you gain the right, but not the obligation, to buy or sell ETH at a predetermined price (strike price) within a specific time frame (expiration date).

Types of Binance ETH Options

Binance offers two types of ETH options: Call options and Put options.

| Type | Description |

|---|---|

| Call Option | Grants you the right to buy ETH at the strike price if the price of ETH exceeds the strike price at expiration. |

| Put Option | Grants you the right to sell ETH at the strike price if the price of ETH falls below the strike price at expiration. |

How to Trade Binance ETH Options

Trading ETH options on Binance is straightforward. Here’s a step-by-step guide:

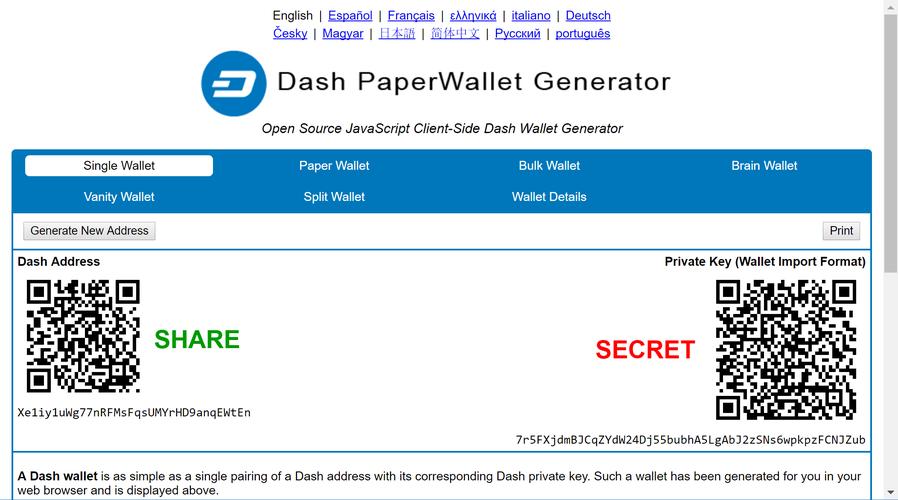

- Sign up for a Binance account and verify your identity.

- Deposit ETH into your Binance account.

- Navigate to the “Futures” section and select “Options” from the dropdown menu.

- Choose the ETH option you want to trade (Call or Put) and select the strike price and expiration date.

- Enter the amount of ETH options you want to buy and click “Buy” or “Sell” to execute the trade.

Understanding Option Prices

Option prices consist of two components: intrinsic value and time value.

- Intrinsic Value: The difference between the current price of ETH and the strike price. For Call options, it’s the amount by which the current price exceeds the strike price. For Put options, it’s the amount by which the strike price exceeds the current price.

- Time Value: The amount by which the option price exceeds its intrinsic value. It represents the potential for the option to increase in value before expiration.

Risks and Rewards of Trading Binance ETH Options

Like all financial instruments, ETH options come with risks and rewards.

Risks:

- Market Risk: The price of ETH can fluctuate significantly, leading to potential losses.

- Liquidity Risk: Some options may be less liquid, making it difficult to buy or sell at desired prices.

- Time Decay: The value of options decreases as the expiration date approaches, leading to potential losses if the price of ETH doesn’t move in your favor.

Rewards:

- High Leverage: Options can offer high leverage, allowing you to control a larger position with a smaller amount of capital.

- Profit Potential: If you correctly predict the direction of ETH’s price movement, options can offer significant profit potential.

Best Practices for Trading Binance ETH Options

Here are some best practices to help you succeed in trading Binance ETH options:

- Understand the basics of options trading and the risks involved.

- Research and analyze the market to make informed decisions.

- Start with a small position and gradually increase your exposure as you gain experience.

- Use risk management techniques, such as setting stop-loss orders, to protect your capital.

- Stay disciplined and avoid emotional decision-making.

By following this comprehensive guide, you’ll be well-equipped to trade Binance ETH options and potentially profit from the volatility of the Ethereum market.