Are Eth Gas Fees Tax Deductible?

Understanding whether Ethereum gas fees are tax deductible can be a complex matter, especially for those who are new to the cryptocurrency space. In this article, we delve into the intricacies of this question, providing you with a comprehensive overview of the topic.

What Are Eth Gas Fees?

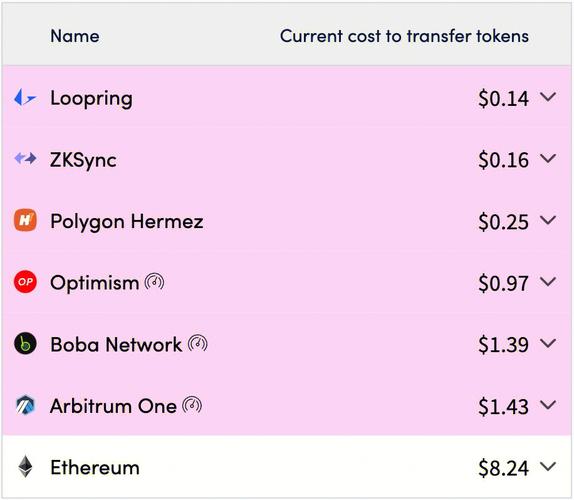

Ethereum gas fees are the transaction fees paid to miners for processing transactions on the Ethereum network. These fees are denoted in Ether (ETH) and are essential for ensuring the smooth operation of the network. When you send ETH or any other cryptocurrency on the Ethereum network, you are required to pay a gas fee.

Are Eth Gas Fees Taxable?

Whether or not Ethereum gas fees are taxable depends on the nature of your transactions. Here are some scenarios to consider:

-

Investment Purposes: If you are using Ethereum for investment purposes, such as buying and selling cryptocurrencies, the gas fees may be tax deductible. This is because you are incurring these expenses to generate income or capital gains.

-

Personal Use: If you are using Ethereum for personal purposes, such as paying for goods or services, the gas fees are generally not tax deductible. This is because you are not generating income or capital gains from these transactions.

-

Business Expenses: If you are using Ethereum for business purposes, such as paying for advertising or purchasing goods, the gas fees may be tax deductible. This is because you are incurring these expenses to generate income for your business.

How to Determine Tax Deductibility

When determining whether Ethereum gas fees are tax deductible, it is essential to consider the following factors:

-

Transaction Purpose: As mentioned earlier, the purpose of your transaction plays a crucial role in determining tax deductibility. Ensure that you have clear records of your transactions and their purposes.

-

Documentation: Keep detailed records of all your Ethereum transactions, including the amount of gas fees paid. This will help you substantiate your tax deductions if required.

-

Accounting Method: Choose an appropriate accounting method for your cryptocurrency transactions. The two most common methods are the cash method and the accrual method. Each method has its own set of rules and regulations regarding tax deductions.

Common Misconceptions

There are several misconceptions surrounding the tax deductibility of Ethereum gas fees. Here are a few to be aware of:

-

Gas Fees Are Always Tax Deductible: This is not true. As mentioned earlier, the tax deductibility of gas fees depends on the nature of your transactions.

-

Gas Fees Are Capital Gains: Gas fees are not considered capital gains. They are simply transaction fees paid to miners.

-

Gas Fees Are Always Taxable: This is also not true. As mentioned earlier, gas fees may be tax deductible if you are using Ethereum for business or investment purposes.

Consult a Tax Professional

Given the complexities of cryptocurrency taxation, it is always advisable to consult a tax professional before claiming any deductions related to Ethereum gas fees. They can provide you with personalized advice based on your specific situation and ensure that you are in compliance with tax regulations.

Conclusion

Understanding whether Ethereum gas fees are tax deductible can be challenging. However, by considering the purpose of your transactions, maintaining detailed records, and consulting a tax professional, you can navigate the complexities of cryptocurrency taxation more effectively.

| Transaction Purpose | Is Gas Fee Tax Deductible? |

|---|---|

| Investment | Yes |

| Personal Use | No |

| Business Expenses | Yes |