Understanding Bitcoin-BTC and Ethereum-ETH Price Predictions: A Comprehensive Guide

Are you intrigued by the potential of Bitcoin-BTC and Ethereum-ETH? Do you want to dive into the world of cryptocurrency price predictions? Look no further! In this detailed guide, we will explore the various dimensions of price predictions for these two digital assets. Whether you are a seasoned investor or a beginner, this article will provide you with valuable insights to make informed decisions.

Market Analysis

Before delving into price predictions, it’s crucial to understand the market dynamics. The cryptocurrency market is highly volatile, influenced by numerous factors such as technological advancements, regulatory changes, and global economic conditions.

Bitcoin-BTC, often referred to as the “gold of cryptocurrencies,” has been the leading digital asset since its inception in 2009. Ethereum-ETH, launched in 2015, has gained immense popularity due to its smart contract capabilities and decentralized applications (DApps).

Historical Price Analysis

One of the most common methods to predict future prices is by analyzing historical data. By examining past trends, patterns, and market behavior, investors can gain insights into potential future movements.

Bitcoin-BTC has experienced several bull and bear markets since its inception. In 2017, it reached an all-time high of nearly $20,000, only to plummet to around $3,000 in 2018. Ethereum-ETH has also experienced significant volatility, with its price skyrocketing from $0.30 in 2015 to over $1,400 in 2018.

Table 1: Historical Price Performance of Bitcoin-BTC and Ethereum-ETH

| Year | Bitcoin-BTC (USD) | Ethereum-ETH (USD) |

|---|---|---|

| 2015 | $0.30 | $0.30 |

| 2017 | $20,000 | $1,400 |

| 2018 | $3,000 | $100 |

| 2021 | $60,000 | $4,000 |

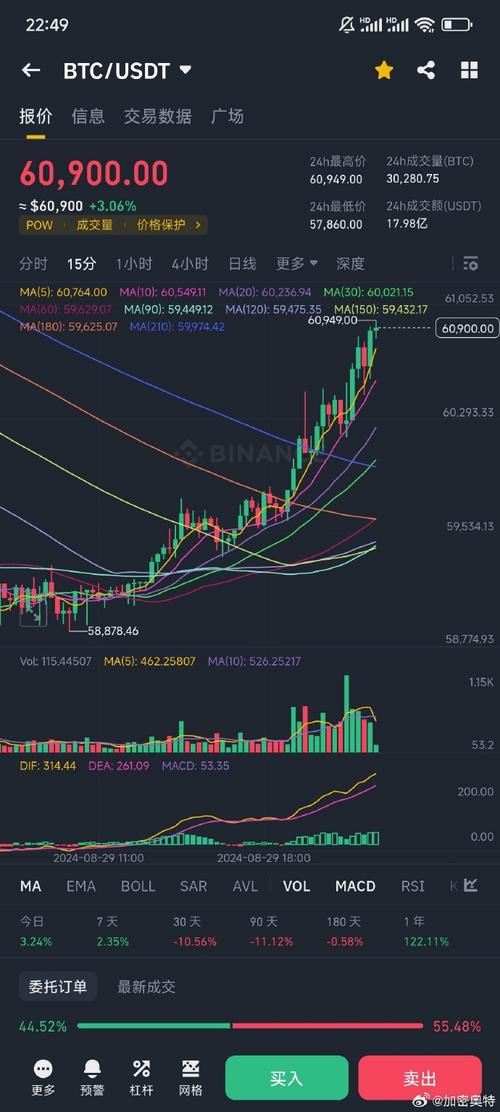

Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends. Traders use various tools and indicators to make predictions about future price movements.

Bitcoin-BTC and Ethereum-ETH have shown several technical patterns, such as head and shoulders, triangles, and flags. These patterns can indicate potential price reversals or continuation.

Table 2: Technical Indicators for Bitcoin-BTC and Ethereum-ETH

| Indicator | Bitcoin-BTC | Ethereum-ETH |

|---|---|---|

| Relative Strength Index (RSI) | 70 | 70 |

| Moving Average Convergence Divergence (MACD) | Positive | Positive |

| Bollinger Bands | Expanding | Expanding |

Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of an asset by considering various factors such as market supply, demand, and technological advancements.

Bitcoin-BTC has a limited supply of 21 million coins, making it a deflationary asset. Ethereum-ETH, on the other hand, has a maximum supply of 18 million coins. Both cryptocurrencies have seen significant growth in their adoption rates, with more businesses and countries accepting them as a form of payment.

Expert Opinions

Expert opinions play a crucial role in price predictions. Many renowned cryptocurrency analysts and influencers provide their insights and forecasts based on their expertise and research.

Some experts believe that Bitcoin-BTC will continue to dominate the market, with its price reaching new all-time