Understanding Binance ETH Staking Fees: A Comprehensive Guide

Binance, one of the largest cryptocurrency exchanges, offers a variety of services to its users, including Ethereum staking. Staking Ethereum on Binance can be a lucrative venture, but it’s important to understand the fees involved. In this article, we’ll delve into the details of Binance ETH staking fees, exploring different aspects to help you make an informed decision.

What are Binance ETH Staking Fees?

Binance ETH staking fees refer to the charges imposed by the platform for allowing users to participate in the Ethereum 2.0 network. These fees are used to compensate validators for their efforts in securing the network and ensuring its smooth operation.

Types of Fees

There are several types of fees associated with Binance ETH staking:

-

Network Transaction Fees:

-

Validator Fees:

-

Slashing Penalties:

-

Withdrawal Fees:

Network Transaction Fees

Network transaction fees are paid to the Ethereum network itself for processing transactions. These fees are determined by the network’s congestion and can vary significantly. When you stake ETH on Binance, you’ll need to pay these fees for any transactions related to your staked assets.

Validator Fees

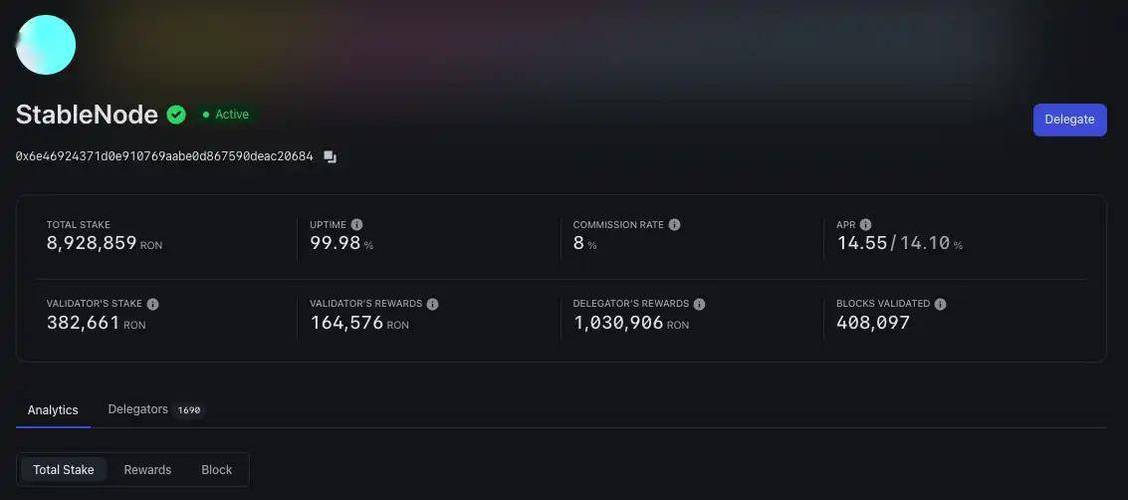

Validator fees are charged by Binance for the service of validating transactions on the Ethereum network. These fees are typically a percentage of the total rewards earned by validators and are used to cover the platform’s operational costs.

Slashing Penalties

Slashing penalties are imposed on validators who violate the rules of the Ethereum network. If a validator is found to be acting maliciously or not following the protocol, their staked ETH can be penalized, resulting in a loss of rewards. Binance may also impose additional penalties for any violations on its platform.

Withdrawal Fees

When you decide to withdraw your staked ETH from Binance, you’ll be charged a withdrawal fee. This fee is used to cover the costs associated with processing the withdrawal and is typically a fixed amount or a percentage of the total amount being withdrawn.

Understanding the Fees

Here’s a table summarizing the different types of fees and their potential impact on your staking rewards:

| Fee Type | Description | Impact on Rewards |

|---|---|---|

| Network Transaction Fees | Fees paid to the Ethereum network for processing transactions | Reduces the overall rewards earned |

| Validator Fees | Fees charged by Binance for validating transactions | Reduces the rewards earned by validators |

| Slashing Penalties | Penalties imposed for violating Ethereum network rules | Can result in a loss of rewards or staked ETH |

| Withdrawal Fees | Fees charged for processing withdrawals | Reduces the amount of ETH received upon withdrawal |

Calculating Your Potential Rewards

Understanding the fees is crucial for calculating your potential rewards. Here’s a simple formula to estimate your rewards:

Estimated Rewards = (Staked ETH Amount Annual Percentage Rate) – Total Fees

Keep in mind that the annual percentage rate (APR) can vary depending on the network’s conditions and Binance’s fee structure.

Comparing Binance ETH Staking Fees with Other Platforms

When considering Binance ETH staking, it’s important to compare the fees with other platforms. Here’s a brief comparison of Binance’s fees with some of its competitors:

| Platform | Network Transaction Fees | Validator Fees | Slashing Penalties | Withdrawal Fees |

|---|---|---|---|---|

B

Related Stories |