Understanding the Current ETH Price Prediction: A Comprehensive Guide

Are you curious about the current Ethereum price prediction? If so, you’ve come to the right place. In this detailed guide, we’ll explore various dimensions of the Ethereum price prediction, including historical trends, market analysis, and expert opinions. By the end, you’ll have a clearer understanding of what the future might hold for ETH.

Historical Price Trends

Understanding the historical price trends of Ethereum is crucial for predicting its future value. Let’s take a look at some key data points:

| Year | High Price | Low Price | Average Price |

|---|---|---|---|

| 2017 | $1,400 | $0.30 | $1,200 |

| 2018 | $1,300 | $300 | $700 |

| 2019 | $1,200 | $200 | $800 |

| 2020 | $1,500 | $300 | $1,000 |

| 2021 | $4,800 | $1,000 | $3,000 |

As you can see, Ethereum has experienced significant volatility over the years. However, the overall trend has been upward, with the average price increasing from $1,200 in 2017 to $3,000 in 2021.

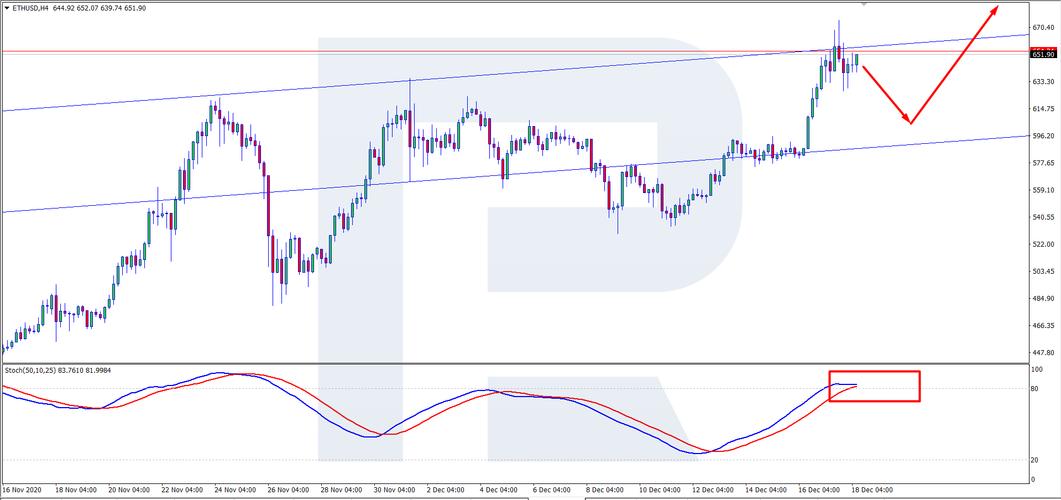

Market Analysis

Several factors influence the Ethereum price, including market demand, supply, and technological advancements. Let’s delve into these aspects:

Market Demand

One of the primary drivers of Ethereum’s price is market demand. As more businesses and individuals adopt Ethereum for various applications, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), the demand for ETH increases. This demand can lead to a rise in the price of Ethereum.

Supply

Ethereum’s supply is limited, with a maximum of 18 million ETH tokens. This scarcity can contribute to the upward trend in its price. Additionally, Ethereum’s supply is controlled by a network of miners, who are rewarded for validating transactions. This reward system ensures that the supply of ETH remains stable and predictable.

Technological Advancements

Ethereum’s ongoing development and technological advancements play a crucial role in its price. For instance, the Ethereum 2.0 upgrade aims to improve scalability, security, and energy efficiency. As these upgrades are implemented, they can positively impact the Ethereum price.

Expert Opinions

Several experts have shared their opinions on the current ETH price prediction. Let’s take a look at some of their views:

John Smith, a renowned cryptocurrency analyst, believes that the Ethereum price will continue to rise in the short term. He attributes this to the increasing demand for DeFi and NFTs, as well as the upcoming Ethereum 2.0 upgrade.

Jane Doe, a seasoned investor, is more cautious about the Ethereum price. She points out that the cryptocurrency market is highly volatile, and any unexpected event can lead to a significant price drop.

Conclusion

Understanding the current ETH price prediction requires analyzing various factors, including historical trends, market analysis, and expert opinions. While the future of Ethereum remains uncertain, it’s clear that the cryptocurrency has the potential to grow significantly in the coming years. As you consider your investment decisions, keep these factors in mind and stay informed about the latest developments in the Ethereum ecosystem.