Are Donations to ETHs Deductible?

When considering the tax implications of donating cryptocurrency, many individuals often wonder if their contributions to Ethereum (ETH) are deductible. The answer to this question can vary depending on several factors, including the nature of the donation, the tax laws of the donor’s country, and the specific circumstances of the donation. Let’s delve into the details to help you understand whether your donations to ETHs are deductible.

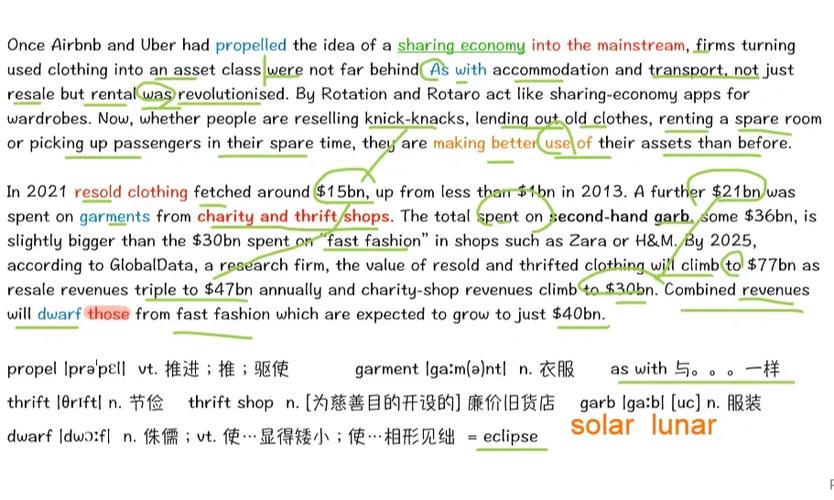

Understanding Cryptocurrency Donations

Cryptocurrency, including Ethereum, is a digital or virtual asset designed to work as a medium of exchange. Unlike traditional currencies, cryptocurrencies are not issued by any central authority and operate on decentralized networks. When you donate ETH, you are essentially transferring a portion of your digital assets to a recipient, which could be an individual, a charity, or a non-profit organization.

U.S. Tax Implications

In the United States, the IRS treats cryptocurrency donations as property, which means they are subject to capital gains tax. Here’s how the tax implications work:

| Donation Type | Capital Gains Tax | Income Tax Deduction |

|---|---|---|

| Donation of Cryptocurrency Held for Less Than a Year | Short-term Capital Gains Tax | Yes, potentially |

| Donation of Cryptocurrency Held for More Than a Year | Long-term Capital Gains Tax | Yes, potentially |

As you can see from the table, whether or not you can deduct your donation depends on how long you held the ETH before donating it. If you held the ETH for more than a year, you may be eligible for a long-term capital gains tax rate, which is typically lower than the short-term rate.

Eligibility for Income Tax Deduction

For your donation to ETH to be deductible, it must meet certain criteria:

-

The recipient must be a qualified charity or non-profit organization recognized by the IRS.

-

You must itemize your deductions on your tax return.

-

The value of the donation must be substantiated with proper documentation, such as a receipt or a written acknowledgment from the charity.

It’s important to note that the IRS has strict guidelines regarding the substantiation of cryptocurrency donations. You must keep records of the amount of cryptocurrency donated, the fair market value of the cryptocurrency at the time of the donation, and the charity’s acknowledgment of the donation.

International Tax Implications

The tax implications of donating ETH can vary significantly depending on your country of residence. Here are some general guidelines for a few popular countries:

-

United Kingdom: Donations to registered charities in the UK are typically tax-deductible. However, the tax treatment of cryptocurrency donations may vary, so it’s essential to consult with a tax professional.

-

Canada: Cryptocurrency donations to registered charities in Canada are tax-deductible. The donor must provide the charity with a written acknowledgment of the donation.

-

Australia: Donations to registered charities in Australia are tax-deductible. The donor must obtain a receipt from the charity to claim the deduction.

It’s crucial to research the tax laws in your specific country to determine the deductibility of your ETH donation.

Conclusion

Whether or not your donations to ETHs are deductible depends on various factors, including the nature of the donation, the tax laws of your country, and the specific circumstances of the donation. It’s essential to consult with a tax professional to ensure you understand the tax implications and take advantage of any available deductions. By doing so, you can make informed decisions about your cryptocurrency donations and potentially reduce your tax burden.