Dollar Cost Averaging ETH: A Comprehensive Guide

Investing in Ethereum (ETH) can be a lucrative venture, but it’s important to approach it with a well-thought-out strategy. One such strategy is dollar cost averaging (DCA), which involves investing a fixed amount of money at regular intervals. This method can help mitigate the risk of market volatility and potentially lead to better long-term returns. In this article, we’ll delve into the ins and outs of dollar cost averaging ETH, providing you with a comprehensive guide to help you make informed decisions.

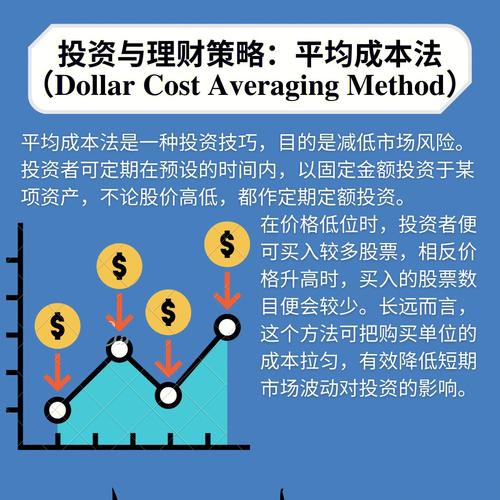

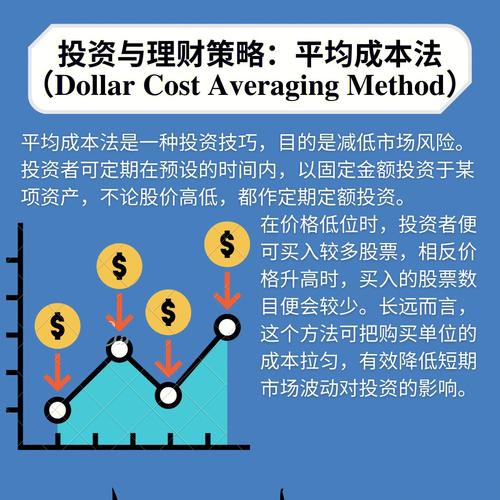

Understanding Dollar Cost Averaging

Dollar cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the price of the asset. This means that you’ll buy more units of the asset when the price is low and fewer units when the price is high. The goal is to reduce the impact of market volatility and lower the average cost per unit over time.

Let’s take a look at an example to illustrate how DCA works. Suppose you decide to invest $100 in ETH every month. If the price of ETH is $1,000, you’ll buy 0.1 ETH. If the price drops to $500, you’ll still invest $100, but now you’ll buy 0.2 ETH. Over time, this strategy can help you accumulate more ETH at a lower average cost.

Benefits of Dollar Cost Averaging ETH

There are several benefits to using dollar cost averaging when investing in ETH:

-

Reduces market risk: By investing a fixed amount at regular intervals, you’re less likely to be affected by market volatility.

-

Improves long-term returns: Over time, the average cost per unit of ETH will decrease, potentially leading to better returns.

-

Eliminates the need for timing the market: Since you’re investing a fixed amount at regular intervals, you don’t have to worry about when to buy or sell.

How to Implement Dollar Cost Averaging ETH

Implementing dollar cost averaging ETH is relatively straightforward. Here’s a step-by-step guide to help you get started:

-

Choose a fixed amount: Decide on the amount of money you want to invest in ETH each month. This could be $50, $100, or any other amount that works for you.

-

Select a regular investment schedule: Decide how often you want to invest. Some investors choose to invest weekly, bi-weekly, or monthly.

-

Open a cryptocurrency wallet: To store your ETH, you’ll need a cryptocurrency wallet. There are many options available, such as MetaMask, Exodus, and Trust Wallet.

-

Set up a recurring investment plan: Use your wallet’s built-in features or a third-party service to set up a recurring investment plan. This will ensure that you invest the fixed amount at the specified intervals.

-

Monitor your investments: Keep track of your ETH investments and the average cost per unit. This will help you understand the progress of your strategy.

Risks and Considerations

While dollar cost averaging ETH can be a beneficial strategy, it’s important to be aware of the risks and considerations involved:

-

Market volatility: The cryptocurrency market is known for its volatility. While DCA can help mitigate this risk, it’s still possible to experience significant price fluctuations.

-

Transaction fees: When buying ETH, you’ll need to pay transaction fees. These fees can vary depending on the network congestion and the chosen cryptocurrency exchange.

-

Long-term commitment: Dollar cost averaging requires a long-term commitment. If you’re not prepared to hold your investments for an extended period, this strategy may not be suitable for you.

Comparing DCA with Other Investment Strategies

When it comes to investing in ETH, there are several strategies to choose from. Let’s compare dollar cost averaging with some of the other popular methods:

| Investment Strategy | Description | Pros | Cons |

|---|---|---|---|

| Dollar Cost Averaging |