Atomic Wallet ETH Staking: A Comprehensive Guide for You

Staking Ethereum (ETH) has become a popular way for cryptocurrency enthusiasts to earn rewards while contributing to the network’s security and decentralization. Atomic Wallet, a versatile cryptocurrency platform, offers a seamless experience for users looking to stake their ETH. In this detailed guide, we’ll explore the various aspects of Atomic Wallet ETH staking, ensuring you have all the information you need to make an informed decision.

Understanding Atomic Wallet ETH Staking

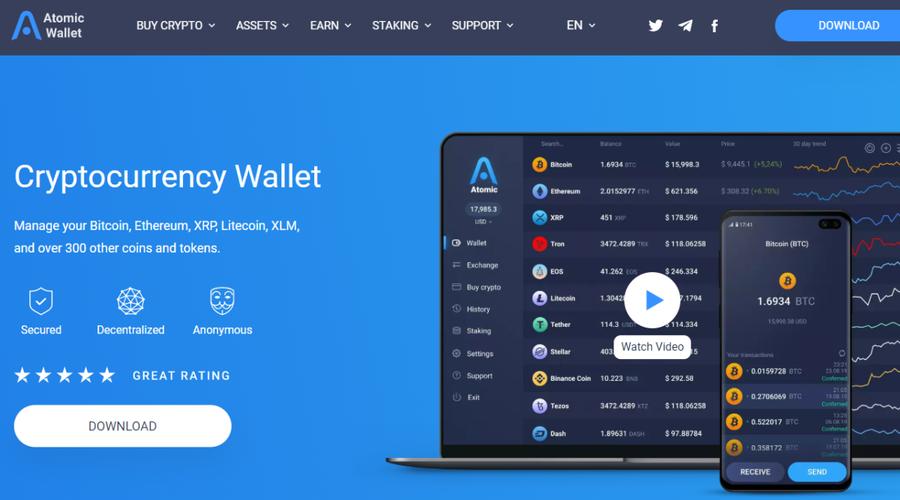

Atomic Wallet is a multi-currency wallet that supports over 300 cryptocurrencies, including Ethereum. The platform allows users to manage their digital assets, trade, and stake their coins. ETH staking in Atomic Wallet involves locking your Ethereum tokens in a smart contract to earn rewards in the form of additional ETH, known as staking rewards.

Before diving into the staking process, it’s essential to understand the key concepts:

- Ethereum 2.0: The upcoming upgrade to the Ethereum network, which will introduce proof-of-stake as the consensus mechanism, replacing the current proof-of-work system.

- Validator: A node operator who locks a certain amount of ETH to participate in the consensus process and validate transactions on the Ethereum network.

- Staking Rewards: The rewards earned by validators for their participation in the network’s consensus process.

Setting Up Atomic Wallet for ETH Staking

Follow these steps to set up Atomic Wallet and start staking your ETH:

- Download and install Atomic Wallet from the official website.

- Open the wallet and create a new account by clicking on the “Create a new account” button.

- Choose a strong password and enter your email address to receive a recovery seed. Write down the recovery seed and keep it in a safe place.

- Click “Next” to create your account.

- Once your account is created, you can import your ETH by clicking on the “Import” button and entering your private key or wallet address.

Staking Your ETH in Atomic Wallet

Now that you have set up Atomic Wallet and imported your ETH, it’s time to start staking:

- Click on the “Staking” tab in the Atomic Wallet interface.

- Select “Ethereum” from the list of available staking options.

- Click on the “Start Staking” button.

- Enter the amount of ETH you want to stake. You can stake a minimum of 32 ETH to become a validator.

- Review the terms and conditions, and click “Confirm” to lock your ETH in the smart contract.

Once your ETH is staked, you will start receiving staking rewards. The rewards are calculated based on the amount of ETH you have staked and the network’s performance. You can view your staking rewards and withdraw them at any time by clicking on the “Withdraw” button in the staking section.

Benefits of Staking ETH in Atomic Wallet

Staking your ETH in Atomic Wallet offers several benefits:

- Reward Earnings: You can earn additional ETH by staking your coins, which can be a significant source of income.

- Network Security: By participating in the consensus process, you contribute to the security and decentralization of the Ethereum network.

- Easy Access: Atomic Wallet provides a user-friendly interface for managing your staking assets and earning rewards.

- Low Fees: Atomic Wallet charges minimal fees for staking and withdrawing rewards.

Risks and Considerations

While staking ETH in Atomic Wallet offers numerous benefits, it’s essential to be aware of the risks and considerations:

- Lock-in Period: Once you lock your ETH in the smart contract, you cannot withdraw it until the lock-in period ends. This period may vary depending on the network’s performance.

- Market Volatility: The value of your staked ETH may fluctuate due to market conditions, which can affect your potential rewards.

- Smart Contract Risks: As with any blockchain-based application, there is a risk of smart contract vulnerabilities or bugs that could