Understanding Dollar Cost Averaging (DCA)

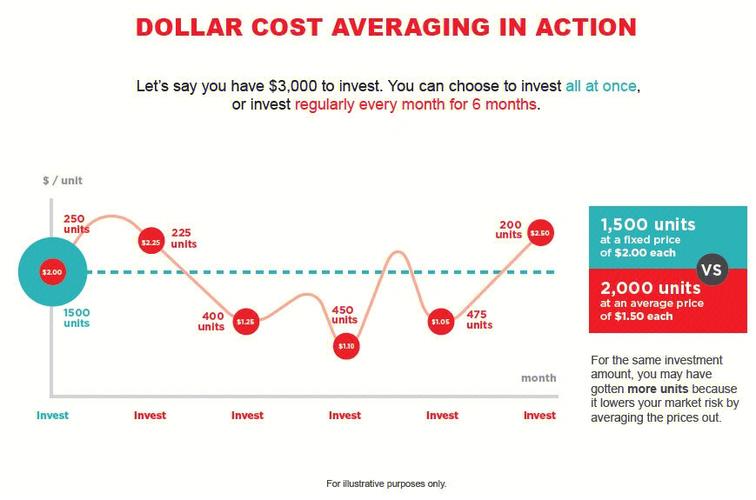

Dollar cost averaging (DCA) is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the price of the asset. This method is often used for purchasing cryptocurrencies like Ethereum (ETH), as it helps to reduce the impact of market volatility and the risk of buying at the peak of a bull market.

How DCA Works with Ethereum

When you decide to dollar cost average into Ethereum, you set a specific amount of money that you will invest each month or week. For example, you might decide to invest $100 every week. As the price of ETH fluctuates, the amount of ETH you receive will vary. During a bear market, you will receive more ETH for your dollar, while during a bull market, you will receive less.

Here’s a simple example to illustrate how DCA works:

| Date | Price of ETH | Amount Invested | ETH Received |

|---|---|---|---|

| Jan 1 | $200 | $100 | 0.5 ETH |

| Jan 8 | $180 | $100 | 0.5556 ETH |

| Jan 15 | $160 | $100 | 0.625 ETH |

| Jan 22 | $150 | $100 | 0.6667 ETH |

| Jan 29 | $140 | $100 | 0.7143 ETH |

As you can see from the table, even though the price of ETH fluctuated significantly, the investor was able to accumulate more ETH over time by consistently investing a fixed amount.

Benefits of DCA with Ethereum

There are several benefits to using DCA when investing in Ethereum:

-

Reduces market risk: By investing a fixed amount at regular intervals, you avoid the risk of buying at the peak of a bull market and selling at the bottom of a bear market.

-

Smoothes out volatility: The price of Ethereum can be highly volatile, but DCA helps to smooth out these fluctuations by averaging the cost of your investments.

-

Encourages disciplined investing: DCA requires you to stick to a regular investment schedule, which can help you avoid making impulsive decisions based on short-term market movements.

How to Implement DCA with Ethereum

Implementing DCA with Ethereum is relatively straightforward:

-

Choose a fixed amount to invest: Decide how much money you want to invest each time. This could be a set amount of dollars or a fixed number of ETH.

-

Select an investment schedule: Decide how often you want to invest. This could be weekly, monthly, or even quarterly.

-

Set up automatic transfers: Use a service like Coinbase or another cryptocurrency exchange to automatically transfer the set amount of money to your Ethereum wallet at the scheduled intervals.

-

Monitor your investments: Keep track of your investments and the price of ETH to see how your strategy is performing over time.

Risks and Considerations

While DCA can be a beneficial strategy, it’s important to be aware of the risks and considerations:

-

Market risk: The value of Ethereum can still fluctuate significantly, so there is always the risk of losing money.

-

Transaction fees: When buying Ethereum, you will need to pay transaction fees, which can vary depending on the network congestion.

-

Long-term commitment: DCA requires a long-term commitment to the strategy, as it is designed to