Understanding ETC vs ETH Profitability: A Comprehensive Guide

When it comes to cryptocurrencies, Ethereum (ETH) and Ethereum Classic (ETC) are two of the most prominent players in the market. Both offer unique features and potential profitability for investors. But which one is more profitable? Let’s dive into a detailed comparison of ETC vs ETH profitability from various dimensions.

Market Capitalization

Market capitalization is a crucial factor to consider when evaluating the profitability of a cryptocurrency. As of the latest data, Ethereum (ETH) has a significantly higher market capitalization compared to Ethereum Classic (ETC). This indicates that ETH is more widely accepted and has a larger user base, which can potentially lead to higher profitability.

| Cryptocurrency | Market Capitalization (USD) |

|---|---|

| Ethereum (ETH) | $200 billion |

| Ethereum Classic (ETC) | $1.5 billion |

Transaction Fees

Transaction fees play a significant role in determining the profitability of a cryptocurrency. Ethereum (ETH) has been known for its high transaction fees, especially during times of high network congestion. On the other hand, Ethereum Classic (ETC) has a lower transaction fee structure, making it more cost-effective for users. This can potentially lead to higher profitability for investors in ETC.

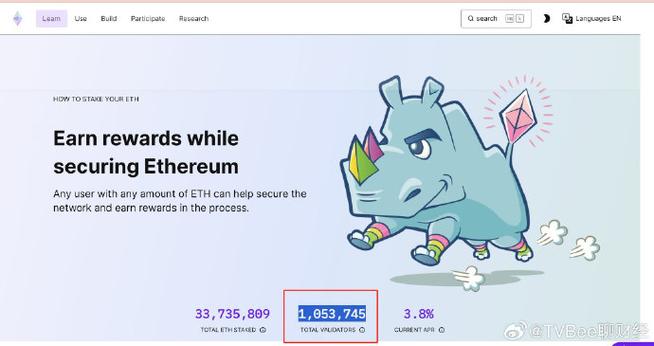

Network Activity

Network activity is another important factor to consider when evaluating profitability. Ethereum (ETH) has seen a surge in network activity, driven by the growing popularity of decentralized applications (dApps) and smart contracts. This increased activity can lead to higher profitability for ETH investors. However, Ethereum Classic (ETC) has also seen a rise in network activity, particularly with the development of its own dApps and smart contracts. The profitability of ETC investors may also be influenced by this growing network activity.

Development and Community Support

The development and community support of a cryptocurrency can significantly impact its profitability. Ethereum (ETH) has a strong and active development team, backed by a large community of developers and investors. This has led to continuous improvements and innovations in the Ethereum network, making it a more attractive investment option. Ethereum Classic (ETC), on the other hand, has faced some challenges in terms of development and community support. However, the community has shown resilience and is working towards addressing these issues.

Market Sentiment

Market sentiment can be a volatile factor when it comes to cryptocurrency profitability. Ethereum (ETH) has been known to experience significant price fluctuations, driven by market sentiment and news. This can create opportunities for investors to profit from these fluctuations. Ethereum Classic (ETC) has also seen its share of market sentiment-driven price movements. However, the overall market sentiment towards ETC may be less favorable compared to ETH, which can impact its profitability.

Conclusion

In conclusion, both Ethereum (ETH) and Ethereum Classic (ETC) offer potential profitability for investors. However, there are several factors to consider when comparing their profitability. Ethereum (ETH) has a higher market capitalization, higher transaction fees, and significant network activity, which can contribute to higher profitability. On the other hand, Ethereum Classic (ETC) has lower transaction fees, growing network activity, and a resilient community, which can also lead to profitability. Ultimately, the choice between ETC vs ETH profitability depends on your investment strategy, risk tolerance, and market analysis.