Understanding ETFs, ETH, and Grayscale: A Comprehensive Guide

When it comes to investing in cryptocurrencies, it’s essential to understand the various tools and platforms available. Two such tools that have gained significant attention are ETFs and Grayscale. Additionally, Ethereum (ETH) remains a popular cryptocurrency. In this article, we will delve into the details of these three components, providing you with a comprehensive understanding of their features, benefits, and potential risks.

What is an ETF?

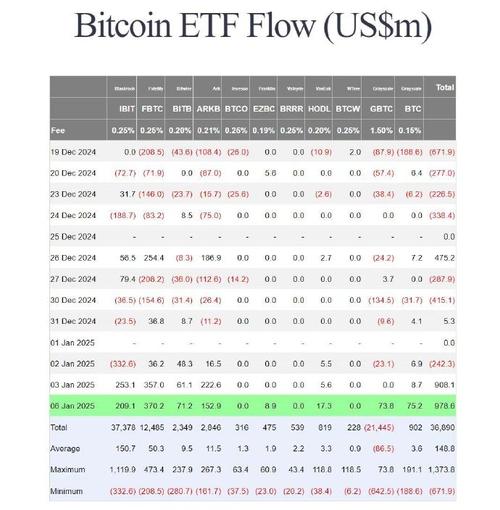

An Exchange-Traded Fund (ETF) is a type of investment fund that tracks the performance of a specific index, commodity, or basket of assets. Unlike stocks, ETFs are bought and sold on exchanges like stocks, which means they can be traded throughout the trading day. One of the most popular ETFs in the cryptocurrency space is the Ethereum ETF (ETH ETF).

ETH ETFs are designed to provide investors with exposure to the price movements of Ethereum without the need to purchase and store the actual cryptocurrency. This can be particularly appealing to investors who are looking to diversify their portfolios or gain exposure to the cryptocurrency market without dealing with the complexities of owning and managing digital assets.

Understanding Grayscale

Grayscale is a digital asset investment company that offers a range of investment products, including Grayscale Ethereum Trust (ETHE). ETHE is a trust that holds Ethereum and issues shares to investors. These shares represent a claim on the underlying Ethereum assets held by the trust.

One of the key advantages of investing in Grayscale products is that they provide exposure to the cryptocurrency market without the need to directly own the cryptocurrency. This can be beneficial for investors who are concerned about the security and storage of digital assets. Additionally, Grayscale products are regulated and audited, which can provide a level of comfort for investors who prefer traditional investment vehicles.

Comparing ETFs and Grayscale Products

While both ETFs and Grayscale products offer exposure to the cryptocurrency market, there are some key differences between the two.

| Feature | ETFs | Grayscale Products |

|---|---|---|

| Regulation | Regulated by the SEC | Regulated by the SEC |

| Trading | Traded on exchanges like stocks | Shares are traded over-the-counter (OTC) |

| Dividends | May pay dividends | Do not pay dividends |

| Investment Strategy | Tracks the performance of a specific index or asset | Holds the actual cryptocurrency assets |

ETFs are typically more liquid and can be traded on exchanges, making them more accessible to a broader range of investors. On the other hand, Grayscale products may offer a more direct exposure to the cryptocurrency market, but they are traded over-the-counter, which can make them less liquid and more challenging to sell.

Risks and Considerations

While investing in ETFs and Grayscale products can offer exposure to the cryptocurrency market, it’s important to be aware of the risks involved.

One of the primary risks is the volatility of the cryptocurrency market. Prices can fluctuate rapidly, leading to significant gains or losses. Additionally, regulatory changes can impact the value of these investments. For example, if a government decides to ban or restrict cryptocurrency trading, it could negatively affect the value of ETFs and Grayscale products.

Another risk to consider is the security of the underlying assets. While Grayscale products are regulated and audited, there is still a risk of theft or loss of the actual cryptocurrency assets. This is a concern that is not present with traditional ETFs, which are typically backed by a basket of assets or an index.

Conclusion

Understanding the intricacies of ETFs, ETH, and Grayscale can help you make informed decisions when investing in the cryptocurrency market. Both ETFs and Grayscale products offer unique advantages and risks, and it’s important to consider your investment goals, risk tolerance, and market conditions before choosing the right investment vehicle for you.