Date, ETH, and ETC: A Detailed Multi-Dimensional Introduction

When it comes to cryptocurrencies, Ethereum (ETH) and Ethereum Classic (ETC) are two of the most prominent names in the industry. Both of these digital assets have their unique features, history, and market dynamics. In this article, we will delve into the details of these two cryptocurrencies, exploring their origins, technological aspects, market performance, and future prospects.

Origins and History

Ethereum was created by Vitalik Buterin, a Russian-Canadian programmer, in 2013. The platform was designed to enable developers to build decentralized applications (DApps) and smart contracts. Ethereum’s native cryptocurrency, ETH, was launched in July 2015, following a successful crowdfunding campaign that raised over $18 million.

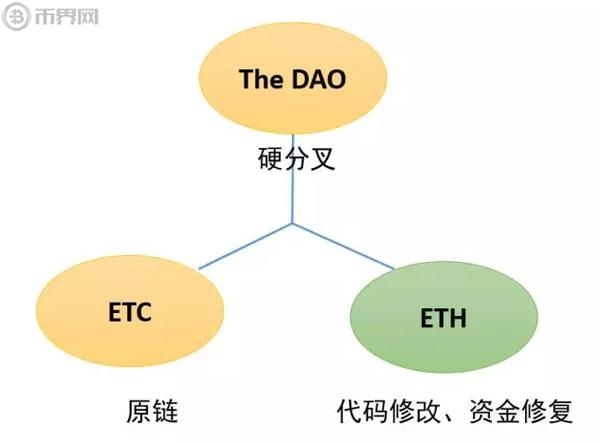

Ethereum Classic, on the other hand, was born out of a hard fork that occurred in 2016. This hard fork was a result of a disagreement among Ethereum community members regarding the handling of a major security breach. Those who opposed the proposed changes chose to continue with the original Ethereum blockchain, thus giving rise to Ethereum Classic (ETC).

Technological Aspects

Ethereum and Ethereum Classic share a similar underlying technology, which is based on blockchain. However, there are some key differences in their technological implementations.

Ethereum uses a proof-of-stake (PoS) consensus mechanism, which is designed to be more energy-efficient than the proof-of-work (PoW) mechanism used by Bitcoin. The PoS mechanism allows validators to create new blocks and earn rewards based on the number of ETH they hold and are willing to “stake” as collateral.

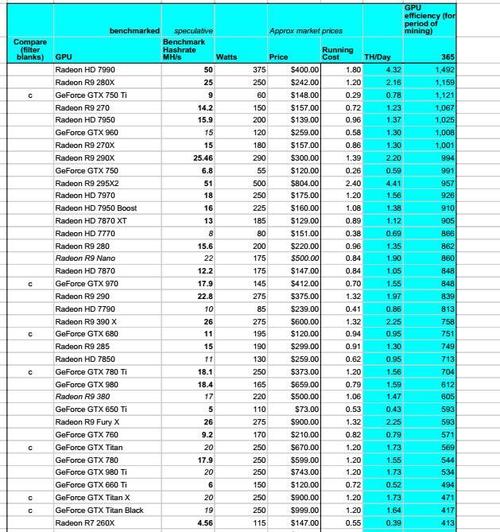

Ethereum Classic, on the other hand, continues to use the PoW mechanism, which requires miners to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain. This has led to higher energy consumption compared to Ethereum’s PoS mechanism.

Market Performance

Both ETH and ETC have experienced significant growth since their inception. Ethereum has been one of the top-performing cryptocurrencies, with its market capitalization often ranking in the top three. The platform’s versatility and the growing number of DApps built on top of it have contributed to its success.

Ethereum Classic has also seen considerable growth, although it has not reached the same level of market capitalization as ETH. The community’s commitment to maintaining the original Ethereum blockchain has helped to sustain its value.

Below is a table comparing the market performance of ETH and ETC over the past few years:

| Year | Ethereum (ETH) | Ethereum Classic (ETC) |

|---|---|---|

| 2017 | $800 | $2.50 |

| 2018 | $1,200 | $15 |

| 2019 | $200 | $5 |

| 2020 | $1,400 | $50 |

| 2021 | $4,000 | $200 |

Future Prospects

The future of ETH and ETC is shaped by various factors, including technological advancements, regulatory developments, and market dynamics.

Ethereum is currently undergoing a major upgrade called Ethereum 2.0, which aims to transition the platform to a PoS consensus mechanism and improve scalability. The success of this upgrade could significantly impact the future of ETH.

Ethereum Classic is also working on various projects to enhance its platform, such as improving its smart contract capabilities and exploring new use cases. The community’s dedication to maintaining the original vision of Ethereum could be a key factor in its future success.

In conclusion, both Ethereum and Ethereum Classic are important players in the cryptocurrency space. Their unique features, market performance, and future prospects make them worth keeping an eye on for those interested in the world of digital assets.