Courser ETH/USD: A Comprehensive Guide

Understanding the cryptocurrency market can be daunting, especially when it comes to trading pairs like ETH/USD. In this article, we delve into the details of the Ethereum/US Dollar trading pair, exploring its history, current trends, and factors that influence its value. Whether you’re a seasoned trader or just dipping your toes into the crypto world, this guide will provide you with the knowledge you need to make informed decisions.

Understanding ETH/USD

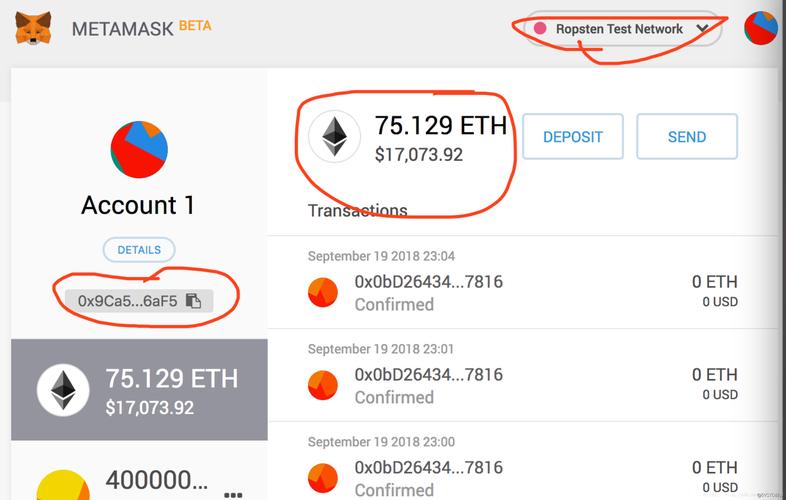

The ETH/USD trading pair represents the exchange rate between Ethereum (ETH), a popular cryptocurrency, and the US Dollar (USD), the world’s most widely used fiat currency. This pair is among the most actively traded on various cryptocurrency exchanges, making it a key indicator of Ethereum’s market performance.

History of ETH/USD

Ethereum was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. Since its inception, the ETH/USD trading pair has experienced significant volatility, reflecting the broader cryptocurrency market’s ups and downs. Initially, Ethereum was priced at a fraction of a dollar, but it has since surged to become one of the top cryptocurrencies by market capitalization.

| Year | ETH/USD Price |

|---|---|

| 2015 | $0.30 – $2.00 |

| 2016 | $0.30 – $14.00 |

| 2017 | $0.30 – $1,400.00 |

| 2018 | $0.30 – $300.00 |

| 2019 | $100.00 – $600.00 |

| 2020 | $200.00 – $4,800.00 |

| 2021 | $1,000.00 – $5,000.00 |

Factors Influencing ETH/USD

Several factors can influence the ETH/USD trading pair’s value. Here are some of the most significant ones:

-

Market Sentiment: The overall sentiment in the cryptocurrency market can greatly impact ETH/USD prices. Positive news, such as increased adoption or regulatory support, can lead to a surge in value, while negative news, such as regulatory crackdowns or security breaches, can cause prices to plummet.

-

Supply and Demand: Like any other asset, the value of ETH/USD is influenced by the balance between supply and demand. An increase in demand for Ethereum can lead to higher prices, while a decrease in demand can cause prices to fall.

-

Technological Developments: Ethereum’s ongoing development, including updates to its blockchain and the launch of new projects, can impact its value. For example, the Ethereum 2.0 upgrade, which aims to improve scalability and reduce energy consumption, has been a significant driver of ETH/USD’s price.

-

Market Competition: The rise of other cryptocurrencies, such as Bitcoin (BTC) and Binance Coin (BNB), can impact ETH/USD’s value. If these alternative assets become more popular, it could lead to a decrease in demand for Ethereum and, consequently, a drop in its price.

-

Economic Factors: Global economic conditions, such as inflation rates, interest rates, and currency fluctuations, can also influence ETH/USD prices. For instance, a weakening US Dollar can make Ethereum more attractive to investors, leading to higher prices.

Trading ETH/USD

Trading ETH/USD involves buying Ethereum with USD and selling it back for USD at a later time, aiming to profit from price fluctuations. Here are some tips for trading this pair:

-

Research: Before trading ETH/USD, it’s crucial to research the market, including historical price charts, news, and technical analysis.