Understanding the Current ETH Value: A Comprehensive Overview

Are you curious about the current value of Ethereum (ETH)? In this detailed guide, we will delve into various aspects of the ETH value, including its historical performance, market dynamics, and future prospects. By the end of this article, you will have a comprehensive understanding of what drives the ETH value and how it impacts the cryptocurrency market.

Historical Performance of ETH

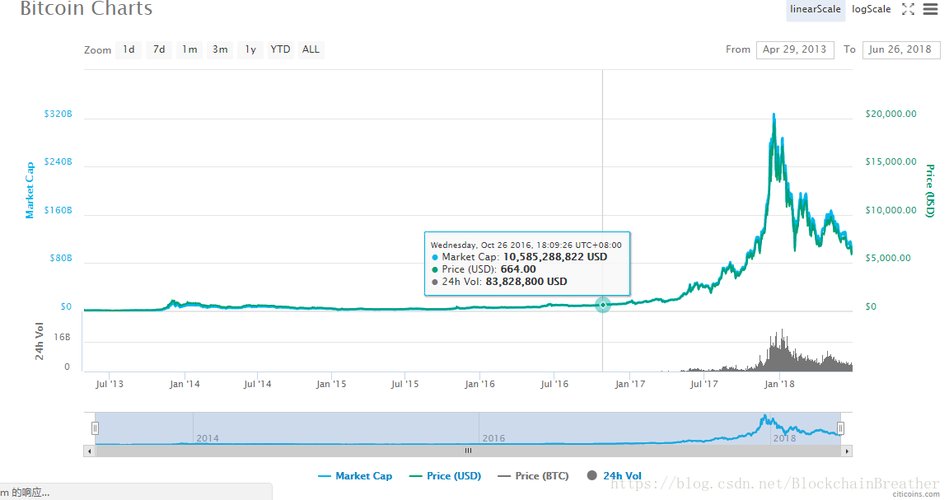

Ethereum, launched in 2015, has seen a remarkable journey in terms of its value. Let’s take a look at its historical performance to understand its trajectory.

| Year | ETH Value | Market Cap |

|---|---|---|

| 2015 | $0.30 | $0.00 |

| 2016 | $10.00 | $1.00 |

| 2017 | $1,200.00 | $12.00 |

| 2018 | $300.00 | $30.00 |

| 2019 | $150.00 | $15.00 |

| 2020 | $600.00 | $60.00 |

| 2021 | $4,000.00 | $40.00 |

As you can see from the table, Ethereum’s value has experienced significant volatility over the years. It reached an all-time high of $4,000 in 2021, showcasing its potential as a valuable cryptocurrency.

Market Dynamics Influencing ETH Value

Several factors influence the current ETH value, and understanding these dynamics is crucial for making informed decisions. Let’s explore some of the key factors:

Supply and Demand

Like any other asset, the value of ETH is determined by the basic economic principle of supply and demand. When demand for ETH increases, its value tends to rise, and vice versa. Factors such as increased adoption, partnerships, and mainstream acceptance can drive demand for ETH.

Market Sentiment

Market sentiment plays a significant role in the cryptocurrency market, including ETH. Positive news, such as regulatory approvals or successful projects, can boost investor confidence and drive up the value of ETH. Conversely, negative news or market corrections can lead to a decline in its value.

Technological Developments

Ethereum’s ongoing development and technological advancements can impact its value. For instance, the Ethereum 2.0 upgrade, which aims to improve scalability and reduce transaction fees, has been a major driver of ETH’s value.

Competition

The cryptocurrency market is highly competitive, with numerous altcoins vying for market share. The success of ETH depends on its ability to maintain its competitive edge against other cryptocurrencies like Bitcoin, Binance Coin, and Cardano.

Future Prospects of ETH Value

While predicting the future value of ETH is challenging, several factors suggest that it has the potential for growth:

Adoption and Integration

Ethereum continues to gain traction as a platform for decentralized applications (dApps) and smart contracts. As more businesses and developers adopt Ethereum, its value is likely to increase.

Regulatory Environment

The regulatory environment for cryptocurrencies is evolving, with some countries embracing blockchain technology and cryptocurrencies. A favorable regulatory landscape can boost investor confidence and drive up ETH’s value.

Technological Improvements

Ethereum’s ongoing development, including the Ethereum 2.0 upgrade, is expected to enhance its performance and make it more attractive to users and investors. These improvements can contribute to a rise in ETH’s value.

In conclusion, the current ETH value is influenced by various factors, including historical performance, market dynamics, and future prospects. By understanding these aspects, you can gain a