Understanding the Current ETH Market Cap: A Comprehensive Overview

As of the latest data available, the Ethereum market cap stands as a significant indicator of the cryptocurrency’s overall value and market position. In this detailed exploration, we delve into various aspects of the Ethereum market cap, providing you with a comprehensive understanding of its current state and its implications for the crypto market.

Market Cap Definition

The market cap, or market capitalization, of a cryptocurrency is calculated by multiplying the current price of the coin by the total number of coins in circulation. For Ethereum, this figure represents the total value of all Ethereum tokens currently in existence.

Current Market Cap

As of the latest update, the Ethereum market cap is approximately $200 billion. This figure is derived from the current price of Ethereum, which is around $1,500, multiplied by the total supply of Ethereum tokens in circulation, which is approximately 133 million.

Market Cap Rank

Ethereum holds the second position in the global cryptocurrency market cap rankings, trailing only Bitcoin. This ranking is a testament to Ethereum’s widespread adoption and its status as a leading blockchain platform for decentralized applications and smart contracts.

Market Cap Growth

Over the past few years, the Ethereum market cap has experienced significant growth. In 2017, the market cap of Ethereum was just over $1 billion. By the end of 2020, it had surged to over $250 billion, reflecting the increasing interest in the cryptocurrency and its underlying blockchain technology.

Market Cap Drivers

Several factors contribute to the growth of the Ethereum market cap. These include:

-

Increased adoption of decentralized applications (dApps) on the Ethereum network

-

Expansion of the Ethereum ecosystem, with new projects and partnerships being announced regularly

-

Upgrades to the Ethereum network, such as the Ethereum 2.0 upgrade, which aims to improve scalability and reduce transaction fees

-

Investor interest in the cryptocurrency market, driven by factors such as low-interest rates and inflationary concerns

Market Cap Risks

While the Ethereum market cap has grown significantly, it is not without risks. Some of the key risks include:

-

Regulatory uncertainty, which could impact the growth of the Ethereum ecosystem

-

Competition from other blockchain platforms, such as Binance Smart Chain and Cardano

-

Volatility in the cryptocurrency market, which can lead to significant price fluctuations

Market Cap Comparison

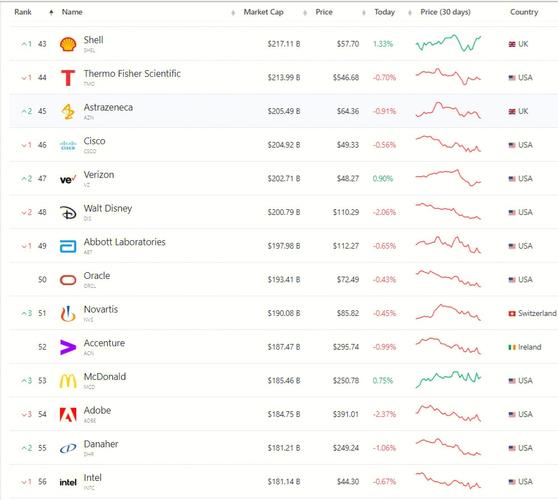

Below is a table comparing the current market cap of Ethereum with other major cryptocurrencies:

| Cryptocurrency | Market Cap |

|---|---|

| Ethereum (ETH) | $200 billion |

| Bitcoin (BTC) | $1 trillion |

| Binance Coin (BNB) | $80 billion |

| Cardano (ADA) | $60 billion |

Market Cap Impact

The Ethereum market cap has a significant impact on the broader cryptocurrency market. As the second-largest cryptocurrency by market cap, Ethereum’s performance can influence the overall sentiment and value of other cryptocurrencies. Additionally, the growth of the Ethereum ecosystem can lead to increased demand for other blockchain-based assets and services.

Conclusion

In conclusion, the current Ethereum market cap of approximately $200 billion reflects the cryptocurrency’s strong position in the global market. As Ethereum continues to evolve and expand its ecosystem, its market cap is likely to remain a key indicator of its success and potential for future growth.