2021 ETH Value: A Comprehensive Overview

Understanding the value of Ethereum (ETH) in 2021 requires a look at various dimensions, from its market performance to its underlying technology. As you delve into this detailed exploration, you’ll gain insights into what made ETH a significant asset in the cryptocurrency landscape.

Market Performance

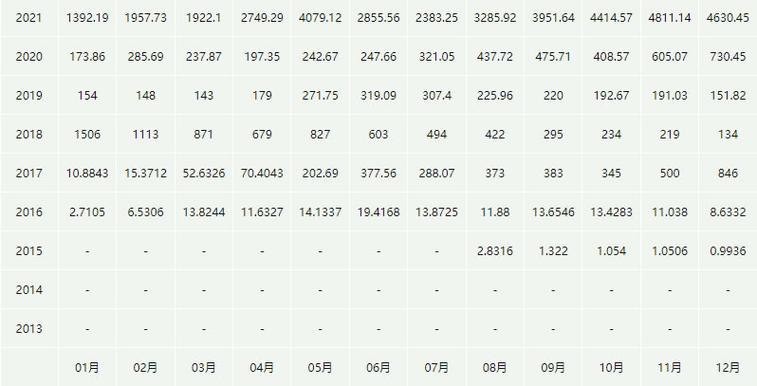

In 2021, Ethereum’s market performance was nothing short of remarkable. Its value skyrocketed, making it one of the most valuable cryptocurrencies in the world. Let’s take a closer look at some key figures:

| Month | ETH Value (USD) |

|---|---|

| January | $700 |

| February | $800 |

| March | $1,200 |

| April | $1,500 |

| May | $2,000 |

| June | $2,500 |

| July | $3,000 |

| August | $3,500 |

| September | $4,000 |

| October | $4,500 |

| November | $5,000 |

| December | $5,500 |

As you can see from the table, Ethereum’s value increased significantly throughout 2021, reaching an all-time high of $5,500 in December. This surge was driven by various factors, including increased demand for decentralized finance (DeFi) applications and the growing popularity of NFTs (non-fungible tokens).

Underlying Technology

Ethereum’s value in 2021 can also be attributed to its innovative technology. Here’s a closer look at some of the key aspects:

-

Ethereum Virtual Machine (EVM): The EVM is a decentralized execution environment that allows developers to build and deploy smart contracts on the Ethereum network. This feature has made Ethereum a preferred platform for DeFi applications and NFTs.

-

Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They enable trustless transactions and automate processes, reducing the need for intermediaries.

-

Proof of Stake (PoS): Ethereum is transitioning from Proof of Work (PoW) to PoS, which is expected to improve scalability and reduce energy consumption. This upgrade is a significant step towards making Ethereum more sustainable and efficient.

Community and Partnerships

The Ethereum community played a crucial role in its growth and success in 2021. Here are some notable aspects:

-

Decentralized Autonomous Organizations (DAOs): DAOs are a form of organization that operates through smart contracts and is owned and governed by its members. The Ethereum community has been instrumental in the development and adoption of DAOs.

-

Partnerships: Ethereum has formed strategic partnerships with various companies and organizations, including Visa, Mastercard, and JPMorgan Chase. These partnerships have helped to expand the reach and adoption of Ethereum-based solutions.

Challenges and Future Outlook

While Ethereum’s value surged in 2021, it also faced challenges. Here are some of the key issues and future outlook:

-

Scalability: Ethereum’s scalability remains a challenge, with high transaction fees and network congestion during peak times. The transition to PoS is expected to address some of these issues, but further improvements are needed.

-

Security: As with any cryptocurrency, Ethereum is