Understanding 173,000 ETH: A Comprehensive Overview

When it comes to the cryptocurrency world, Ethereum (ETH) stands out as one of the most popular and influential digital assets. With a market capitalization that can fluctuate significantly, understanding the implications of owning 173,000 ETH is crucial. Let’s delve into the various dimensions of this substantial amount of Ethereum.

Market Value of 173,000 ETH

The value of 173,000 ETH can vary greatly depending on the current market conditions. As of the latest data, Ethereum’s price is hovering around $2,000 per ETH. To calculate the total value, simply multiply the number of ETH by the current price:

| Number of ETH | Price per ETH | Total Value |

|---|---|---|

| 173,000 | $2,000 | $346,000 |

However, keep in mind that this is just an estimate, and the actual value can change rapidly.

Investment Potential

When considering the investment potential of 173,000 ETH, it’s essential to analyze various factors:

-

Market Trends: The cryptocurrency market is highly volatile, and trends can change rapidly. It’s crucial to stay informed about market developments and adjust your investment strategy accordingly.

-

Network Activity: Ethereum’s network activity, such as transaction volume and smart contract usage, can impact its value. Higher activity often indicates increased demand and potential growth.

-

Competitive Landscape: Ethereum faces competition from other blockchain platforms, such as Binance Smart Chain and Cardano. Understanding the competitive landscape can help you assess the long-term potential of your investment.

Use Cases of Ethereum

Ethereum is not just a digital currency; it’s a platform that supports various applications and use cases:

-

Smart Contracts: Ethereum’s most significant innovation is the ability to create and execute smart contracts. These self-executing contracts automate transactions and eliminate the need for intermediaries.

-

DApps (Decentralized Applications): Ethereum hosts numerous decentralized applications, ranging from financial services to gaming and social media platforms.

-

Tokenization: Ethereum allows the creation of various tokens, including utility tokens, security tokens, and stablecoins. This feature enables businesses to raise capital and tokenize assets.

Risks and Considerations

While investing in 173,000 ETH can be lucrative, it’s essential to be aware of the risks involved:

-

Market Volatility: The cryptocurrency market is known for its extreme volatility. Prices can skyrocket, but they can also plummet rapidly.

-

Regulatory Risks: Cryptocurrency regulations are still evolving, and changes in regulations can impact the market and your investment.

-

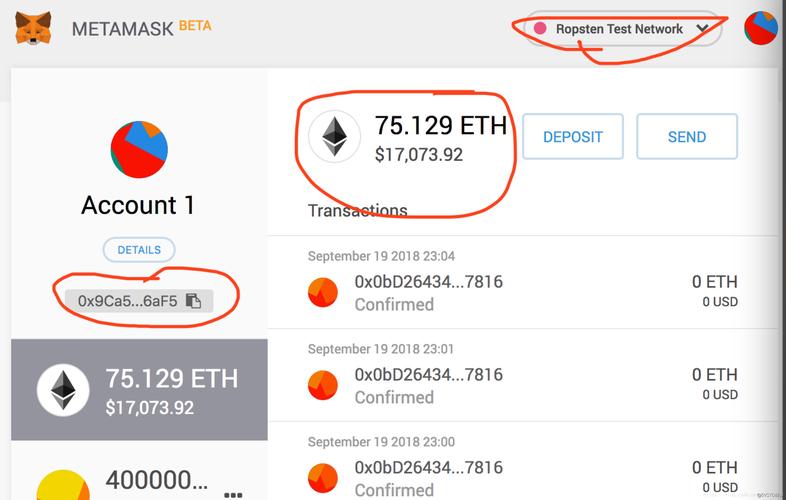

Security Concerns: As with any digital asset, there are security risks associated with storing and transferring Ethereum. It’s crucial to use secure wallets and follow best practices to protect your investment.

Conclusion

Understanding the various dimensions of owning 173,000 ETH is crucial for making informed investment decisions. By analyzing market trends, considering use cases, and being aware of the risks involved, you can better navigate the cryptocurrency market and potentially maximize your returns.