Understanding the Value of 42.069 ETH

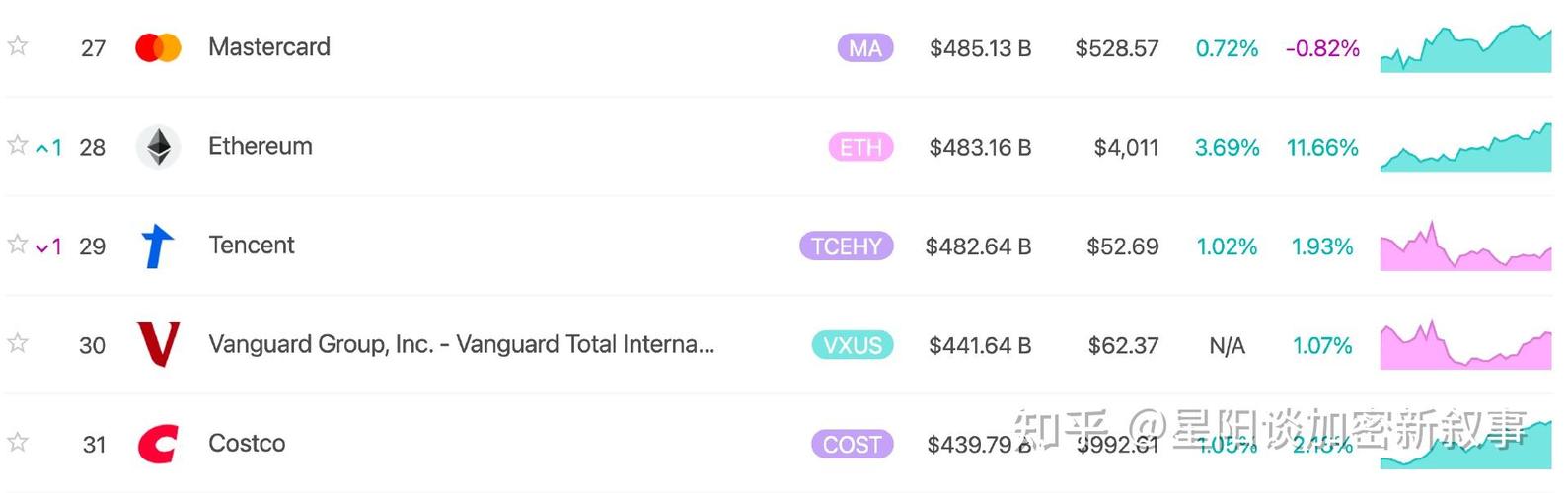

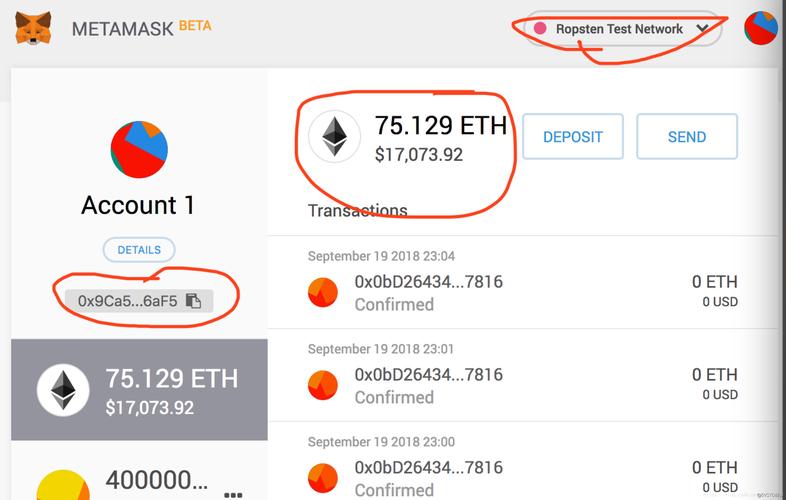

When it comes to the world of cryptocurrencies, understanding the value of a specific amount, such as 42.069 ETH, can be quite intriguing. Ethereum (ETH) has become one of the most popular digital assets, and its price has seen significant fluctuations over the years. Let’s delve into the details of what this amount represents and the factors that influence its value.

Historical Price of ETH

Ethereum’s price has experienced numerous highs and lows since its inception in 2015. As of the latest available data, the highest recorded price for ETH was in January 2018, reaching a remarkable $1424.30. This surge in value was primarily driven by the overall boom in the cryptocurrency market and the growing interest in ETH as the primary fuel for smart contracts and decentralized applications on the Ethereum blockchain.

However, this peak was short-lived, and ETH prices began to decline, reaching a low of $130.72 in December 2019. The following year, in March 2020, the COVID-19 pandemic caused a significant downturn in the cryptocurrency market, with ETH prices plummeting below $90, reaching a low of $89.21. This event, known as “Black Thursday,” marked the lowest point in ETH’s price history.

Despite these fluctuations, ETH prices have shown a long-term upward trend. In May 2021, ETH prices reached a new all-time high of $4382, driven by the launch of Ethereum 2.0 and the rise of decentralized finance (DeFi) applications. The introduction of Ethereum 2.0 addressed issues of network capacity, while the increasing popularity of DeFi projects further boosted demand for ETH.

Factors Influencing ETH Price

The value of ETH is influenced by various factors, including market supply and demand, regulatory policies, technological advancements, and broader economic conditions. Here are some key factors that can impact the price of ETH:

| Factor | Description |

|---|---|

| Market Supply and Demand | The balance between the number of ETH available in the market and the demand for it can significantly impact its price. Factors such as new investors entering the market or existing holders selling their ETH can influence supply and demand dynamics. |

| Regulatory Policies | Government regulations and policies regarding cryptocurrencies can have a substantial impact on ETH prices. For example, the approval or rejection of regulatory frameworks can affect investor confidence and the overall market sentiment. |

| Technological Advancements | Innovations and improvements in the Ethereum network, such as the Ethereum 2.0 upgrade, can positively impact ETH prices. These advancements can enhance network efficiency, scalability, and security, making ETH more attractive to users and investors. |

| Broader Economic Conditions | Global economic conditions, including inflation rates, interest rates, and currency fluctuations, can indirectly influence ETH prices. For example, during times of economic uncertainty, investors may seek refuge in cryptocurrencies, leading to increased demand for ETH. |

Future Outlook for ETH

The future of ETH is shaped by a combination of factors, including technological advancements, regulatory developments, and market dynamics. Here are some potential trends that could impact the value of ETH:

-

Continued Growth of DeFi: The DeFi sector is expected to continue expanding, driving demand for ETH as the preferred platform for smart contracts and decentralized applications.

-

Ethereum 2.0 Upgrade: The successful completion of the Ethereum 2.0 upgrade is anticipated to enhance network performance and scalability, potentially attracting more users and investors to the platform.

-

Regulatory Clarity: As regulatory frameworks become clearer, investor confidence may increase, leading to higher demand for ETH.

-

Competition from Other Blockchains: The rise of alternative blockchain platforms may impact ETH’s market share and, consequently, its price.

In conclusion, the value of 42.069 ETH is influenced by a multitude of factors, including historical price trends, market dynamics, and broader economic conditions. As the cryptocurrency market continues to evolve, understanding these factors can help you make informed decisions about your investments.