Average ETH Miner Fee: A Comprehensive Overview

Understanding the average Ethereum miner fee is crucial for anyone looking to engage in cryptocurrency transactions. The miner fee is a small amount of Ether (ETH) that miners require to process your transaction. This fee varies based on network congestion and demand. In this article, we will delve into the various aspects of the average ETH miner fee, including its calculation, factors affecting it, and its impact on your transactions.

How is the Average ETH Miner Fee Calculated?

The average ETH miner fee is calculated by taking the total amount of Ether paid in fees over a specific period and dividing it by the number of transactions processed during that time. This calculation provides a rough estimate of the average fee you can expect to pay for a transaction on the Ethereum network.

Here’s a simple formula to calculate the average ETH miner fee:

| Total Ether Paid in Fees | Number of Transactions | Average ETH Miner Fee |

|---|---|---|

| 100 ETH | 50 Transactions | 2 ETH |

Factors Affecting the Average ETH Miner Fee

Several factors influence the average ETH miner fee, making it fluctuate over time. Here are some of the key factors:

- Network Congestion: When the Ethereum network is busy, miners can process more transactions, leading to higher fees. Conversely, during periods of low network activity, fees tend to be lower.

- Transaction Size: Larger transactions require more computational resources, resulting in higher fees. Smaller transactions, on the other hand, are less demanding and may have lower fees.

- Priority: Users can set a priority level for their transactions, which can affect the miner fee. Higher priority transactions may have higher fees, ensuring faster processing.

- Market Conditions: The overall market conditions, including the demand for ETH and the value of the cryptocurrency, can also impact miner fees.

Impact of the Average ETH Miner Fee on Your Transactions

The average ETH miner fee can significantly impact your transactions in several ways:

- Transaction Speed: Higher fees can ensure faster processing of your transaction, reducing the time it takes to be confirmed on the Ethereum network.

- Transaction Cost: The miner fee is an additional cost associated with your transaction. Higher fees mean a higher overall transaction cost.

- Accessibility: High fees can make it difficult for some users, especially those with limited funds, to engage in cryptocurrency transactions.

How to Estimate Your ETH Miner Fee

Estimating your ETH miner fee is essential to plan your transactions effectively. Here are a few methods to help you estimate your miner fee:

- Use a Fee Estimator Tool: There are various online fee estimator tools available that can help you estimate your miner fee based on current network conditions and your transaction size.

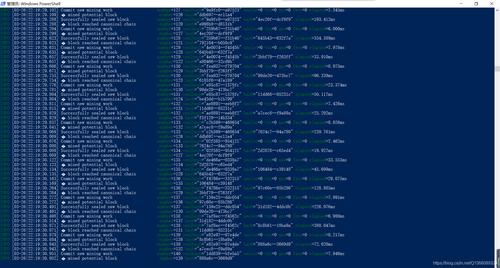

- Check the Blockchain Explorer: Blockchain explorers like Etherscan provide real-time data on miner fees, allowing you to gauge the current average fee and adjust your transaction accordingly.

- Consider Your Transaction Priority: If you’re willing to wait a bit longer for your transaction to be processed, you can opt for a lower fee, saving on transaction costs.

Conclusion

Understanding the average ETH miner fee is vital for anyone engaging in Ethereum transactions. By considering the factors affecting miner fees and using fee estimator tools, you can make informed decisions about your transactions. Keep in mind that the average ETH miner fee can fluctuate significantly, so staying updated with the current network conditions is essential.