Understanding the Triad: ADA vs ETH vs BTC

When it comes to cryptocurrencies, three names stand out: ADA, ETH, and BTC. Each has its unique features, strengths, and weaknesses. In this detailed comparison, we’ll delve into the intricacies of these digital assets, exploring their market performance, technological foundations, and potential future developments.

Market Performance

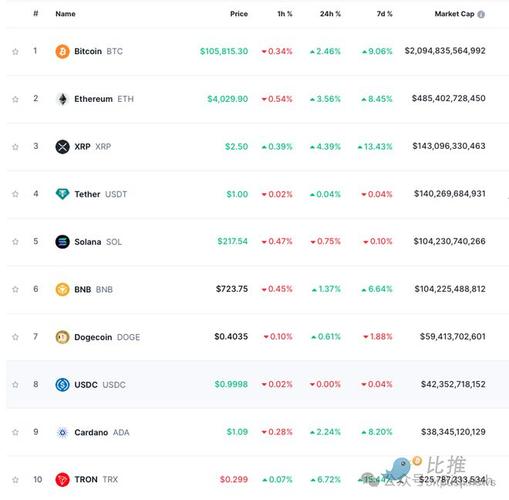

Market performance is a critical factor in evaluating any cryptocurrency. Let’s take a look at how ADA, ETH, and BTC have fared over time.

| Cryptocurrency | Market Cap | Price | Market Cap Rank |

|---|---|---|---|

| ADA | $34.5 billion | $1.15 | 8th |

| ETH | $242.5 billion | $1,860 | 2nd |

| BTC | $460.5 billion | $49,000 | 1st |

As you can see, BTC holds the top spot in terms of market cap and price, followed by ETH and ADA. However, it’s essential to note that market performance can be volatile, and rankings can change rapidly.

Technological Foundations

Understanding the technological foundations of ADA, ETH, and BTC is crucial in evaluating their potential for future growth.

ADA: Cardano’s Vision

ADA is the native cryptocurrency of the Cardano blockchain, a project founded by Charles Hoskinson, one of the co-founders of Ethereum. Cardano aims to be a more sustainable and scalable blockchain platform compared to its predecessors.

Cardano’s technological foundation includes a unique proof-of-stake algorithm called Ouroboros, which aims to provide a more energy-efficient and secure network. Additionally, Cardano has a layered architecture, separating the settlement layer (where ADA is used) from the computation layer, allowing for more versatile and scalable applications.

ETH: Ethereum’s Evolution

Ethereum, founded by Vitalik Buterin, is the first blockchain platform to introduce smart contracts, enabling decentralized applications (dApps) to be built on top of it. Over the years, Ethereum has evolved, with its current version, Ethereum 2.0, focusing on improving scalability, security, and sustainability.

Ethereum’s technological foundation includes a proof-of-stake consensus mechanism, which aims to reduce energy consumption and improve network efficiency. The platform also features a sharding mechanism, which allows for more transactions to be processed simultaneously, enhancing scalability.

BTC: The Original Gold Standard

BTC, created by an anonymous person or group known as Satoshi Nakamoto, is the first and most well-known cryptocurrency. Its technological foundation is based on a proof-of-work consensus mechanism, which requires miners to solve complex mathematical puzzles to validate transactions and secure the network.

BTC’s limited supply of 21 million coins has made it a popular store of value, with many investors considering it the “digital gold.” However, the proof-of-work mechanism has been criticized for its high energy consumption.

Conclusion

When comparing ADA, ETH, and BTC, it’s clear that each has its unique strengths and weaknesses. BTC remains the gold standard in terms of market cap and price, but its energy-intensive proof-of-work mechanism is a concern. ETH has made significant strides in improving scalability and sustainability, while ADA aims to be a more energy-efficient and versatile platform.

Ultimately, the choice between these cryptocurrencies depends on your investment goals, risk tolerance, and beliefs about the future of blockchain technology.