Best ETH Staking Returns: A Comprehensive Guide

Staking Ethereum (ETH) has emerged as a popular way for investors to earn returns on their holdings. With the rise of decentralized finance (DeFi) and the increasing interest in blockchain technology, many are looking for the best possible returns on their ETH. In this article, we will delve into the various aspects of ETH staking, including the different platforms, the potential returns, and the risks involved.

Understanding Ethereum Staking

Ethereum staking is a process where you lock up your ETH tokens to participate in the Ethereum network’s consensus mechanism. By doing so, you help secure the network and are rewarded with additional ETH in return. This process is known as Proof of Stake (PoS), and it’s a more energy-efficient alternative to the Proof of Work (PoW) system used by Bitcoin.

When you stake your ETH, you become a validator. Validators are responsible for validating transactions and adding new blocks to the Ethereum blockchain. In return for their efforts, validators receive staking rewards, which are a portion of the transaction fees paid by users on the Ethereum network.

Top Staking Platforms

There are several platforms where you can stake your ETH, each with its own set of features and potential returns. Here are some of the most popular ones:

| Platform | Minimum Stake | Annual Return | Pros | Cons |

|---|---|---|---|---|

| MyEtherWallet (MEW) | 32 ETH | 4.5% – 5% | Easy to use, no fees | Limited support |

| Ethermine | 32 ETH | 4.5% – 5% | High liquidity, no fees | Complex setup |

| Staked | 32 ETH | 5% – 6% | Low fees, easy to use | Limited support |

| InfStones | 32 ETH | 5% – 6% | High liquidity, no fees | Complex setup |

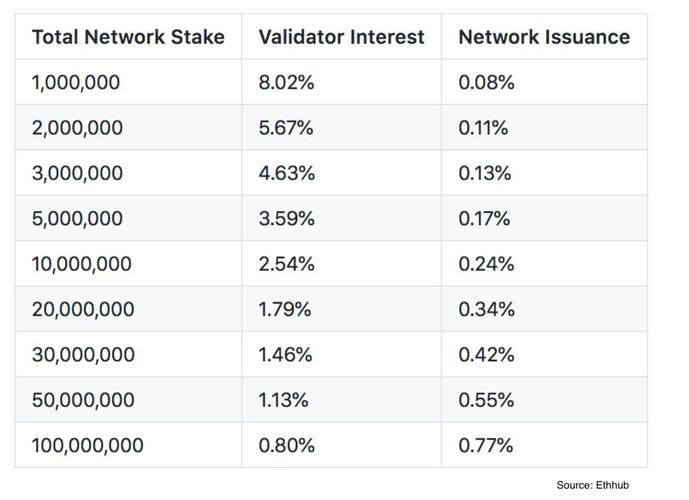

As you can see from the table above, the annual returns vary slightly between platforms, but the minimum stake required is generally 32 ETH. It’s important to note that the returns are subject to change based on the Ethereum network’s performance and the number of validators participating in the network.

Calculating Potential Returns

Calculating the potential returns from ETH staking is relatively straightforward. You simply need to multiply the amount of ETH you’re staking by the annual return percentage. For example, if you’re staking 32 ETH and the annual return is 5%, you would earn 1.6 ETH per year.

It’s important to keep in mind that these returns are not guaranteed. The actual returns you receive will depend on a variety of factors, including the Ethereum network’s performance, the number of validators, and the overall market conditions.

Risks Involved in ETH Staking

While ETH staking can be a lucrative investment, it’s important to be aware of the risks involved:

-

Market Risk: The value of ETH can fluctuate significantly, which can impact the overall returns from staking.

-

Network Risk: If the Ethereum network experiences issues or if the PoS mechanism is compromised, it could impact the returns from staking.

-

Regulatory Risk: Changes in regulations could impact the ability to stake ETH or the returns you receive.

It’s important to do your research and understand the risks before deciding to stake your ETH.

Conclusion

Staking ETH can be a great way to earn returns on your holdings, but it’s important to do your research and understand the risks involved. By choosing the right platform and being aware of the potential returns and risks, you can