APR ETH 2.0: A Comprehensive Guide

Are you intrigued by the world of blockchain and cryptocurrency? Have you heard about Ethereum 2.0 and its potential to revolutionize the industry? If so, you’re in the right place. In this article, we’ll delve into the details of APR ETH 2.0, exploring its features, benefits, and how it compares to other blockchain technologies. Get ready to dive into the fascinating world of decentralized finance and the future of digital assets.

Understanding Ethereum 2.0

Ethereum 2.0, also known as Eth2, is the highly anticipated upgrade to the Ethereum network. It aims to address some of the limitations of the current system, such as scalability and energy consumption. By shifting to a proof-of-stake (PoS) consensus mechanism, Ethereum 2.0 aims to create a more efficient and sustainable blockchain platform.

One of the key features of Ethereum 2.0 is the introduction of sharding. Sharding is a technique that divides the network into smaller, more manageable pieces, allowing for faster transaction processing and improved scalability. This means that Ethereum 2.0 can handle a higher number of transactions per second, making it more suitable for decentralized applications (dApps) and smart contracts.

Proof-of-Stake (PoS)

Proof-of-Stake is a consensus mechanism that replaces the energy-intensive proof-of-work (PoW) system used by Bitcoin and Ethereum. In PoS, validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This incentivizes validators to act honestly and ensures the security of the network.

By adopting PoS, Ethereum 2.0 aims to reduce energy consumption by approximately 99.95%. This is a significant improvement over the current PoW system, which requires a vast amount of electricity to mine new blocks. The shift to PoS also makes Ethereum more accessible to individuals who may not have the resources to mine with PoW.

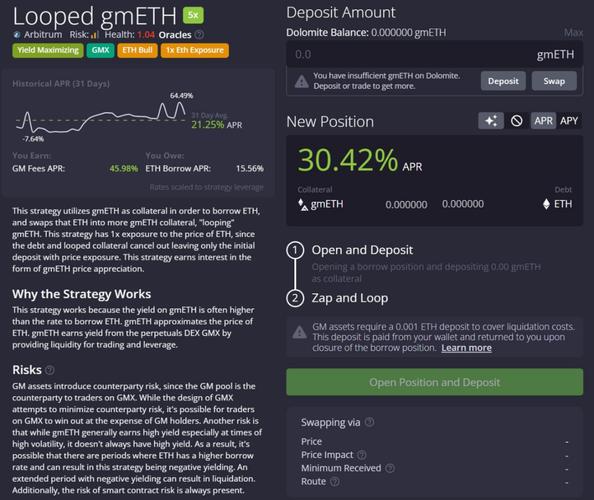

APR ETH 2.0: What is it?

APR ETH 2.0 refers to the annual percentage rate (APR) that you can earn by staking your Ethereum on the Ethereum 2.0 network. Staking is the process of locking up your ETH to participate in the network’s consensus mechanism and earn rewards. The APR represents the percentage of your staked ETH that you can expect to earn over a year.

It’s important to note that the APR for ETH 2.0 can vary depending on several factors, including the network’s overall health, the number of validators, and the supply of ETH in the network. As more validators join the network, the competition for rewards may increase, potentially lowering the APR for new stakers.

How to Stake ETH 2.0

Staking ETH 2.0 is a straightforward process, but it requires a few steps to get started. Here’s a brief overview:

-

Ensure you have enough ETH to stake. The minimum amount required to become a validator is 32 ETH.

-

Choose a staking service provider. There are several reputable providers that can help you stake your ETH, such as Lido, Rocket Pool, and Stake Capital.

-

Connect your Ethereum wallet to the staking service provider. You’ll need to deposit your ETH into the provider’s smart contract.

-

Wait for your ETH to be activated. Once your ETH is deposited, it will be locked for a period of time, typically 18 months, during which you cannot withdraw your funds.

-

Start earning rewards. Once your ETH is activated, you’ll begin earning rewards based on the network’s current APR.

Comparing APR ETH 2.0 to Other Staking Opportunities

When considering staking your ETH, it’s essential to compare the potential returns with other staking opportunities. Here’s a table comparing the APR for ETH 2.0 with other popular cryptocurrencies:

| Cryptocurrency | APR ETH 2.0 | APR BTC | APR ADA | APR DOT |

|---|---|---|---|---|

| Ethereum | 5-8% |