Understanding the Binance ETH/USDT Price: A Comprehensive Guide

When it comes to cryptocurrency trading, Binance is one of the most popular platforms, and ETH/USDT is one of the most traded pairs. Whether you’re a seasoned trader or just starting out, understanding the Binance ETH/USDT price is crucial. In this article, we’ll delve into the various aspects that influence this price, how to analyze it, and what it means for your trading decisions.

What is Binance ETH/USDT?

Binance ETH/USDT refers to the trading pair of Ethereum (ETH) and Tether (USDT) on the Binance exchange. Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications, while Tether is a stablecoin designed to maintain a 1:1 ratio with the US dollar. This pair is popular among traders because it allows them to speculate on the price of Ethereum without being exposed to the volatility of Bitcoin or other cryptocurrencies.

Factors Influencing the Binance ETH/USDT Price

Several factors can influence the Binance ETH/USDT price. Here are some of the key ones:

| Factor | Description |

|---|---|

| Market Supply and Demand | The basic principle of supply and demand applies to the cryptocurrency market. An increase in demand for ETH can lead to a rise in its price, while a decrease in demand can cause it to fall. |

| Market Sentiment | Traders’ emotions and perceptions of the market can significantly impact prices. Positive news about Ethereum or the broader cryptocurrency market can lead to increased demand and higher prices. |

| Regulatory News | Announcements or changes in regulations can have a significant impact on the cryptocurrency market. For example, news of increased regulation in a major market can lead to a decrease in demand for ETH. |

| Technological Developments | Advancements in Ethereum’s technology, such as new updates or improvements, can boost investor confidence and lead to increased demand for ETH. |

| Economic Factors | Global economic conditions, such as inflation or interest rates, can influence the demand for cryptocurrencies as an alternative investment. |

How to Analyze the Binance ETH/USDT Price

There are several methods you can use to analyze the Binance ETH/USDT price and make informed trading decisions:

- Technical Analysis: This involves studying historical price data and using various tools and indicators to predict future price movements. Common technical indicators include moving averages, RSI (Relative Strength Index), and Fibonacci retracement levels.

- Fundamental Analysis: This involves analyzing the underlying factors that affect the value of Ethereum, such as its supply, demand, and technological advancements.

- Market Sentiment Analysis: This involves monitoring news, social media, and other sources to gauge the overall sentiment of the market.

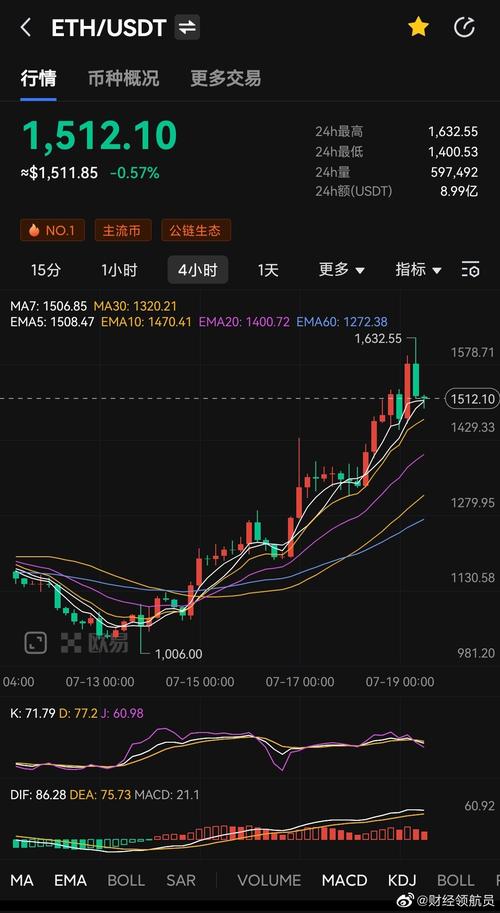

Understanding the Binance ETH/USDT Price Chart

The Binance ETH/USDT price chart is a visual representation of the price of Ethereum over a specific period. Here’s what you need to know about reading the chart:

- Time Frame: The time frame of the chart shows the duration over which the price data is displayed. Common time frames include 1 minute, 5 minutes, 15 minutes, 1 hour, 4 hours, 1 day, 1 week, and 1 month.

- Price Bars: Each bar on the chart represents a specific time frame, with the opening, closing, high, and low prices for that period.

- Volume: The volume shows the number of ETH/USDT trades executed during the time frame. A high volume indicates strong interest in the pair.

- Indicators: Various indicators can be overlaid on the chart to provide additional insights into price movements.

What the Binance ETH/USDT Price Means for Your Trading Decisions

Understanding the Binance ETH/