Understanding the BlackRock ETH Spot ETF: A Comprehensive Guide

Investing in cryptocurrencies has become increasingly popular, and with the rise of digital assets, many investors are looking for ways to gain exposure to the market. One such investment vehicle is the BlackRock ETH Spot ETF. In this article, we will delve into the details of this ETF, exploring its features, benefits, risks, and how it compares to other investment options.

What is the BlackRock ETH Spot ETF?

The BlackRock ETH Spot ETF is a financial product designed to track the price of Ethereum, one of the largest and most popular cryptocurrencies. Unlike other Ethereum-based ETFs that use derivatives, this ETF directly invests in the actual Ethereum tokens, providing investors with a more direct exposure to the asset.

How Does the BlackRock ETH Spot ETF Work?

The BlackRock ETH Spot ETF is structured as an exchange-traded fund (ETF), which means it is traded on a stock exchange. When you invest in this ETF, you are essentially buying shares of the fund, which in turn invests in Ethereum tokens. The value of your investment will fluctuate based on the price of Ethereum in the market.

Here’s a step-by-step breakdown of how the BlackRock ETH Spot ETF works:

-

Investors purchase shares of the ETF on a stock exchange.

-

The ETF purchases Ethereum tokens from the market.

-

The ETF holds the Ethereum tokens in a secure custodian.

-

Investors can buy and sell shares of the ETF throughout the trading day.

Benefits of the BlackRock ETH Spot ETF

Investing in the BlackRock ETH Spot ETF offers several benefits, including:

-

Direct Exposure to Ethereum: Unlike other ETFs that use derivatives, this ETF provides direct exposure to the actual Ethereum tokens, allowing investors to benefit from the asset’s price movements.

-

Regulatory Oversight: As an ETF, the BlackRock ETH Spot ETF is subject to regulatory oversight, which can provide investors with a sense of security and transparency.

-

Dividends: The ETF may distribute dividends to investors, depending on the performance of Ethereum.

-

Low Fees: The BlackRock ETH Spot ETF may have lower fees compared to other investment options, making it a cost-effective way to gain exposure to Ethereum.

Risks Associated with the BlackRock ETH Spot ETF

While the BlackRock ETH Spot ETF offers several benefits, it also comes with its own set of risks:

-

Market Volatility: Cryptocurrencies, including Ethereum, are known for their high volatility. This can lead to significant price fluctuations, which may result in substantial gains or losses for investors.

-

Regulatory Risk: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations could impact the performance of the ETF.

-

Security Concerns: As with any digital asset, there is a risk of security breaches and theft. While the BlackRock ETH Spot ETF is designed to mitigate these risks, they still exist.

Comparing the BlackRock ETH Spot ETF to Other Investment Options

When considering the BlackRock ETH Spot ETF, it’s important to compare it to other investment options, such as:

-

Cryptocurrency Exchanges: While exchanges offer direct access to Ethereum, they may not provide the same level of regulatory oversight and security as the BlackRock ETH Spot ETF.

-

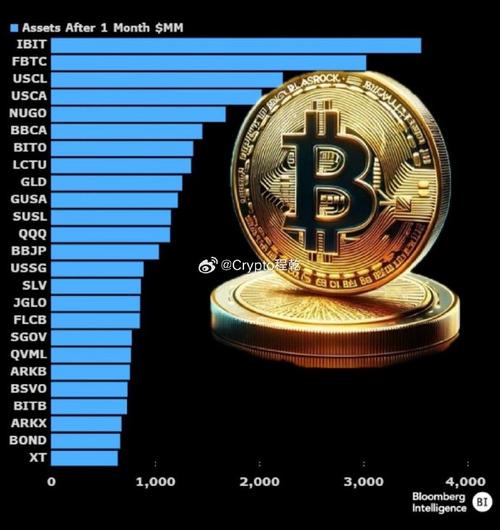

Bitcoin ETFs: Bitcoin is another popular cryptocurrency, and there are several Bitcoin ETFs available. While these ETFs offer similar benefits to the BlackRock ETH Spot ETF, they track a different asset.

-

Broader Cryptocurrency Funds: Some funds offer exposure to a basket of cryptocurrencies, including Ethereum. These funds may provide diversification, but they may not offer the same level of direct exposure to Ethereum as the BlackRock ETH Spot ETF.

Conclusion

The BlackRock ETH Spot ETF is a unique investment vehicle that offers direct exposure to Ethereum, with the added benefits of regulatory oversight and