Avalanche Wrapped ETH: A Comprehensive Guide

Are you curious about Avalanche Wrapped ETH (WETH)? If so, you’ve come to the right place. In this detailed guide, we’ll explore what WETH is, how it works, its benefits, and its potential impact on the blockchain ecosystem. Let’s dive in.

What is Avalanche Wrapped ETH (WETH)?

Avalanche Wrapped ETH, commonly referred to as WETH, is a token that represents Ethereum (ETH) on the Avalanche blockchain. It allows users to interact with Ethereum-based applications and services directly on the Avalanche network, without the need for a bridge or intermediary.

How Does WETH Work?

WETH is created through a process called wrapping, which involves locking ETH in a smart contract on the Ethereum network and minting an equivalent amount of WETH on the Avalanche network. This process is facilitated by the Wrapped (WRP) token, which serves as a bridge between the two blockchains.

When you want to wrap ETH into WETH, you send your ETH to the WETH contract on Ethereum, and in return, you receive WETH tokens. Conversely, when you want to unwrap WETH back into ETH, you send your WETH tokens to the WETH contract on Avalanche, and you receive ETH in return.

Benefits of WETH

There are several benefits to using WETH:

-

Interoperability: WETH allows users to seamlessly interact with Ethereum-based applications and services on the Avalanche network, without the need for a bridge or intermediary.

-

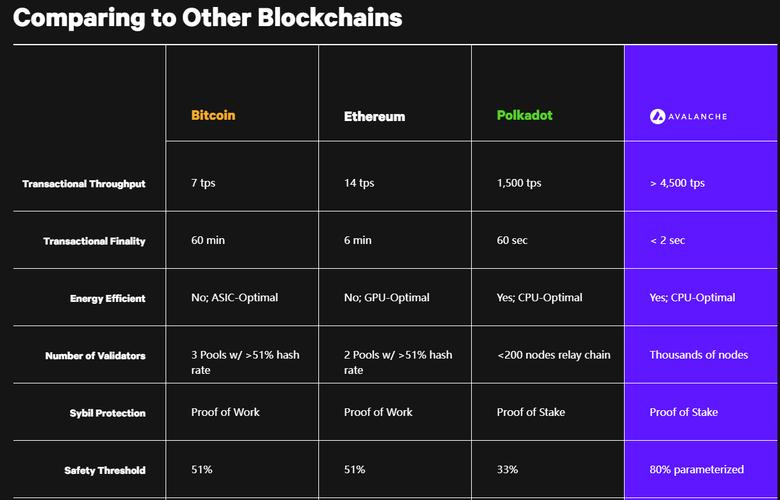

Speed: Transactions on the Avalanche network are significantly faster than on Ethereum, which means users can enjoy lower transaction fees and faster confirmation times.

-

Scalability: The Avalanche network is designed to handle high transaction volumes, making it an ideal platform for decentralized applications (dApps) that require high throughput.

-

Security: The Avalanche network is known for its high level of security, thanks to its unique consensus mechanism and decentralized architecture.

Use Cases for WETH

WETH can be used in various ways, including:

-

Trading: Users can trade WETH on decentralized exchanges (DEXs) on the Avalanche network, just like they would with ETH on Ethereum.

-

Staking: Users can stake WETH to earn rewards on the Avalanche network, similar to staking ETH on Ethereum.

-

DeFi: Users can access decentralized finance (DeFi) applications on the Avalanche network using WETH, including lending, borrowing, and yield farming.

-

Smart Contracts: Developers can deploy smart contracts on the Avalanche network that interact with WETH, enabling new use cases and applications.

Comparison with Other Wrapped Tokens

WETH is one of several wrapped tokens available on the market, such as Wrapped Bitcoin (WBTC) and Wrapped Binance Coin (wBNB). Here’s a brief comparison:

| Token | Underlying Asset | Blockchain | Use Cases |

|---|---|---|---|

| WETH | Ethereum | Avalanche | Interoperability, trading, staking, DeFi, smart contracts |

| WBTC | Bitcoin | Ethereum | Interoperability, trading, staking, DeFi, smart contracts |

| wBNB | Binance Coin | Binance Smart Chain | Interoperability, trading, staking, DeFi, smart contracts |

Future Outlook for WETH

The adoption of WETH and other wrapped tokens is expected to grow as more users and developers discover the benefits of using blockchain networks like Avalanche. As the Avalanche ecosystem continues to expand, WETH is likely to play a significant role in facilitating interoperability and innovation.

With its fast transaction speeds, low fees, and high level of